On a YoY basis manufacturing is the star of the show. But note from the historical graph that residential construction previously has turned down first, with manufacturing and other non-residential construction lagging (likely because of long lead times and the extended duration of completing projects). A big increase holds up construction spending in October; and construction spending is holding up the economy – by New Deal democrat Construction spending for October was reported last Friday, and every sector but nonresidential ex-manufacturing showed increases: Total spending was up 0.6%, residential a sharp 1.2%, and manufacturing 0.9%. Only nonresidential ex-manufacturing declined, by less than -0.1%. The big increase in

Topics:

NewDealdemocrat considers the following as important: December 2023, Hot Topics, Inflation Reduction Act?, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

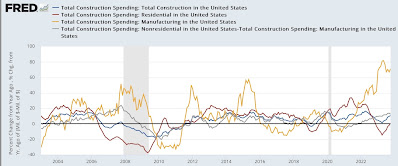

On a YoY basis manufacturing is the star of the show. But note from the historical graph that residential construction previously has turned down first, with manufacturing and other non-residential construction lagging (likely because of long lead times and the extended duration of completing projects).

A big increase holds up construction spending in October; and construction spending is holding up the economy

– by New Deal democrat

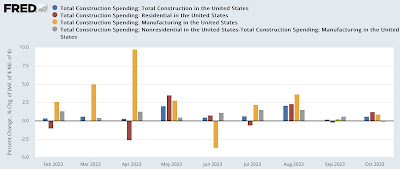

Construction spending for October was reported last Friday, and every sector but nonresidential ex-manufacturing showed increases:

Total spending was up 0.6%, residential a sharp 1.2%, and manufacturing 0.9%. Only nonresidential ex-manufacturing declined, by less than -0.1%.

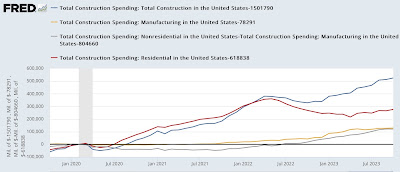

The big increase in manufacturing construction due to the Inflation Reduction Act, which has encouraged re-shoring, has helped keep total construction spending positive. But so has other non-residential construciton, as shown by this graph which norms each category to zero just before the pandemic:

On a YoY basis manufacturing is the star of the show. But note from the historical graph that residential construction previously has turned down first, with manufacturing and other non-residential construction lagging (likely because of long lead times and the extended duration of completing projects):

But as the first graph above shows, on an absolute scale manufacturing construction has been a secondary player except for the period between December of last year and May of this year, in which it accounted for almost 2/3’s of the entire gain. Since then, residential construction improvement has again moved to the fore.

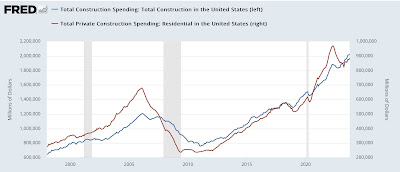

Historically residential construction spending has moved generally on a coincident basis with the number of building units under construction (except that the former, of course, is affected by inflation):

The decline in building costs (gold, below) helps explain why residential building construction has not just held up, but actually increased even as a big increase in mortgage rates has caused a big decline in permits and starts:

And the fact that construction spending has improved so much is a big reason why the economy has continued to expand. With manufacturing less of a factor overall, construction is a bigger pard of the goods-producing part of the economy. Unless and until construction rolls over, therefore, it is unlikely that the economy as a whole will roll over as well.

Why has residential building construction remained so strong, despite the recessionary-level decline in permits and starts? Angry Bear, New Deal democrat.