Credit conditions worsen, and likely to worsen further due to Debt Ceiling Debacle II – by New Deal democrat The Senior Loan Officer Survey, which measures credit on offer by banks, and the demand for credit by their customers, was released yesterday afternoon for Q1, and the news – unsurprisingly – was not good. Credit conditions not only tightened, but they tightened at a higher rate than they had in previous quarters, as about half of all banks tightened terms for credit (in the below graph, a positive number means tightening, i.e., is worse for the economy): Note that in the past, more often than not credit conditions were at their most tight even before recessions began. Not only that, but more than half of all banks reported

Topics:

NewDealdemocrat considers the following as important: 2023, Debt Ceiling Debacle II, Hot Topics, New Deal Democrat, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Credit conditions worsen, and likely to worsen further due to Debt Ceiling Debacle II

– by New Deal democrat

The Senior Loan Officer Survey, which measures credit on offer by banks, and the demand for credit by their customers, was released yesterday afternoon for Q1, and the news – unsurprisingly – was not good.

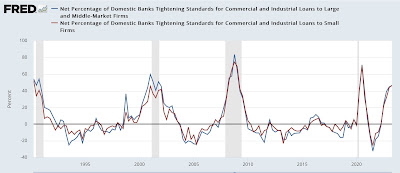

Credit conditions not only tightened, but they tightened at a higher rate than they had in previous quarters, as about half of all banks tightened terms for credit (in the below graph, a positive number means tightening, i.e., is worse for the economy):

Note that in the past, more often than not credit conditions were at their most tight even before recessions began.

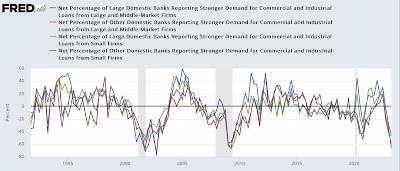

Not only that, but more than half of all banks reported that demand for new loans by commercial customers had declined:

The number of banks reporting reduced demand is on par with the worst of the last few recessions.

What this report tells us is that the economy has been continuing to grow based on the “catching up” on supply chain bottlenecks both on the producer and consumer sides. New demand for and offers of credit for capital projects is drying up.

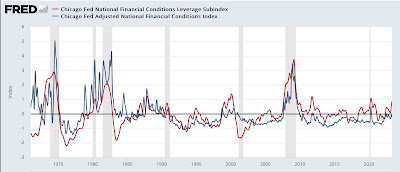

There’s one other ominous sign, at least for the short term. Below is a graph of several weekly measure of financial conditions by the Chicago Fed. In these indexes, like the data above, a positive number is poor. Typically these reasonably approximate, and give advance notice of, the quarterly data in the Senior Loan Officer Survey.

The leverage subindex (red), touted by the Chicago Fed as the most leading, has done exactly that, as it is presently at levels that more often than not in the past have occurred shortly before or during recessions. The Adjusted Index, which leads but with a less variable record, is still below zero:

Here’s the ominous note: the two times that the leverage subindex has been as poor as it is now, but not associated with recessions, were:

(1) the stock market crash of 1987.

(2) the debt ceiling crisis of 2011.

That the leverage index is at those levels, as we appear headed for yet another debt ceiling train wreck, is as I said above, ominous.

I went back and checked my posts from that period in 2011. In August and September, all of the monthly data – long leading, short leading, coincident, you name it – tanked in unison, to the point where it appeared a recession may have already and suddenly started. It should not be surprising at all if the same occurs as we approach the brink of a debt default again.

Credit conditions in Q4 were recessionary, Angry Bear, New Deal democrat