In which I quibble with Prof. Alan Blinder about the main reason for the decline in inflation since June – by New Deal democrat Alan S. Blinder is getting traction for an opinion piece published in the WSJ concerning the big decline in inflation since June. He acknowledges that“ energy inflation played a meaningful role” but that “the rest of the stunning drop in inflation in 2022 [is] due … What did change dramatically was the supply bottlenecks. Major contributors to inflation in 2021 and the first half of 2022, they are now mostly behind us.”While I agree that supply bottlenecks are “mostly behind us,” the phrase “the rest of” in his analysis appears to be doing some heavy lifting. Here is a graph of total CPI (blue), CPI less food and

Topics:

NewDealdemocrat considers the following as important: Energy prime reason for declining inflation, Hot Topics, New Deal Democrat, politics, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

In which I quibble with Prof. Alan Blinder about the main reason for the decline in inflation since June

– by New Deal democrat

Alan S. Blinder is getting traction for an opinion piece published in the WSJ concerning the big decline in inflation since June. He acknowledges that“ energy inflation played a meaningful role” but that “the rest of the stunning drop in inflation in 2022 [is] due … What did change dramatically was the supply bottlenecks. Major contributors to inflation in 2021 and the first half of 2022, they are now mostly behind us.”

While I agree that supply bottlenecks are “mostly behind us,” the phrase “the rest of” in his analysis appears to be doing some heavy lifting.

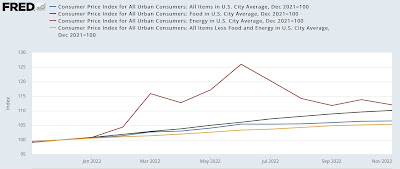

Here is a graph of total CPI (blue), CPI less food and energy (gold), CPI for food (gray), and CPI for energy (red):

In the 6 months through June, total inflation increased at an 11.1% rate, core inflation at 6.9%, food 12.6%, and energy 58.8%. At an annualized rate, in the past 5 months total inflation has been 2.4%, core 4.6%, food 9.3%, and energy -28.4%.

Put another way, since June annualized total inflation has gone down from 11.1% to 2.4% (a 78% decline), core inflation from 6.9% to 4.6% (a 33% decline), food from 12.6% to 9.3%, and energy from 58.8% to -28.4%.

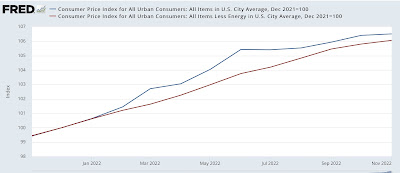

An even better way to look at this is to compare total inflation (blue, just as above) with CPI less energy (red). In the first 6 months through June CPI less energy increased at a 7.7% rate, and since then at a 5.3% rate (a 31% decline):

Again, focusing on the most important aspect, the rate of decline in core inflation since June has been 33%, inflation ex-energy 31%, but total inflation including energy 78%. So, in terms of CPI .it’s pretty clear that energy has been the primary reason by far that the rate of inflation has declined.

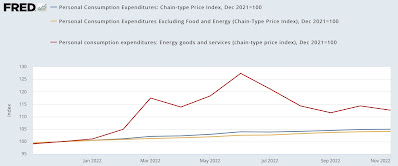

Measured using PCE, total PCE prices were up 8.0% at an annualized rate, core PCE less food and energy was up 5.3%, and energy was up 62.3%. Since June, at an annualized rate, total PCE costs were up 2.4%, core PCE prices up 3.6%, and energy costs down -29.8%:

Unfortunately, there’s no “PCE cost index less energy” on FRED, but the pattern as compared with CPI inflation is the same. Comparing the first 6 months of this year with the last 5 on an annualized basis, core PCE cost increases declined 32%, but total PCE costs including energy and food declined 70%. Presumably if we stripped out food, the decisive impact of energy price declines would be even more clear.

So, while the abatement of supply bottlenecks is surely a factor, by far the decisive factor in the decline in inflation is the huge decline in the price of gas.

Finally, a note that I nevertheless come to the same ultimate conclusion as Professor Binder, which is that the Fed ought to declare victory and go home, but mainly because so much of the remaining part of core inflation that is problematic is tied up with the badly lagging “owner’s equivalent rent,” whereas actual house price increases are on track to be completely unchanged YoY by the middle of this year.