Unlike homeowners, home builders can alter their product and (much more flexibly) their price point – by News Deal democrat Yesterday I noted that home builders, unlike existing homeowners trying to sell their existing house, have flexibility in the size and amenities of the house they will build, as well as the price they are willing to set, based on commodity costs and profit margins. Today’s new home sales report for July confirmed that, as sales rose to 714,000 annualized, the highest level since February 2022 on a seasonally adjusted basis. As I have frequently pointed out, new home sales are the most leading of any housing metric, but they do have the drawback of being very noisy and heavily revised. Below I compare them (blue) with

Topics:

NewDealdemocrat considers the following as important: August 2023, Home builders, Hot Topics, New Deal Democrat, Product and pricing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Unlike homeowners, home builders can alter their product and (much more flexibly) their price point

– by News Deal democrat

Yesterday I noted that home builders, unlike existing homeowners trying to sell their existing house, have flexibility in the size and amenities of the house they will build, as well as the price they are willing to set, based on commodity costs and profit margins.

Today’s new home sales report for July confirmed that, as sales rose to 714,000 annualized, the highest level since February 2022 on a seasonally adjusted basis. As I have frequently pointed out, new home sales are the most leading of any housing metric, but they do have the drawback of being very noisy and heavily revised. Below I compare them (blue) with single family permits (red, right scale) which are much less noisy:

I suspect that level will not survive the increase in mortgage rates to over 7.25% in the past week, the highest rate inn over 20 years.

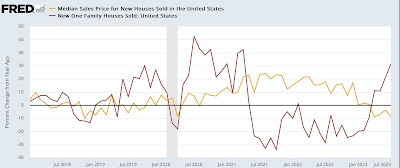

The report does not seasonally adjust prices, so the best way to look is YoY. Below I compare those (gold) with the YoY% change in sales (red):

The median price of new homes has declined -8.7% over the past 12 months, vs. existing homes, which as we saw yesterday, are actually *higher* YoY.

This dynamic cannot last beyond the short term. I suspect it will change as soon as commodity prices for home building materials (chiefly lumber) have unequivocally stopped declining, and homeowners feel a profit squeeze.

House prices stabilize (or even increase!) for existing homes, while prices have been slashed for new homes. What’s going on? Angry Bear, New Deal democrat