Initial claims improve weekly, continue to suggest slow weaking – by New Deal democrat [Reminder: I’m still traveling, so with no economic news, don’t expect a post tomorrow.] Initial jobless claims declined to 230,000 last week. The more important 4 week average increased to 236,750. Continuing claims, with a one week lag, declined slightly to 1.702 million: The YoY% change in the 4 week average, more important for forecasting purposes, increased to 11%, and measured monthly so far for August is up 10%:: This indicates some continued weakening in the jobs market, and at 10% on a monthly basis, renews a yellow caution flag. But to signal an oncoming recession requires 2 months in a row of a 12.5% YoY or higher increase in claims. While

Topics:

NewDealdemocrat considers the following as important: August 2023, Hot Topics, New Deal Democrat, US EConomics, weekly claims

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Initial claims improve weekly, continue to suggest slow weaking

– by New Deal democrat

[Reminder: I’m still traveling, so with no economic news, don’t expect a post tomorrow.]

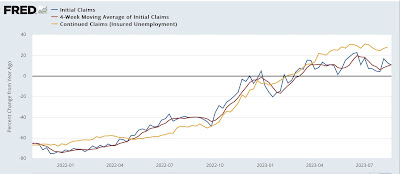

Initial jobless claims declined to 230,000 last week. The more important 4 week average increased to 236,750. Continuing claims, with a one week lag, declined slightly to 1.702 million:

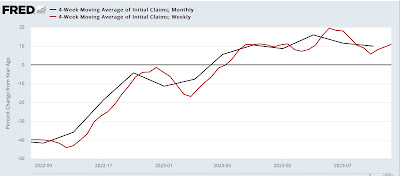

The YoY% change in the 4 week average, more important for forecasting purposes, increased to 11%, and measured monthly so far for August is up 10%::

This indicates some continued weakening in the jobs market, and at 10% on a monthly basis, renews a yellow caution flag. But to signal an oncoming recession requires 2 months in a row of a 12.5% YoY or higher increase in claims. While the current situation continues to suggest that the unemployment rate will increase perhaps 02% or even 0.3% in the coming months, there is no recession signal in this metric currently.

Initial claims travelin’ man edition: still below cautionary levels, Angry Bear, New Deal democrat