A big jump in motor vehicle sales highlights a good September for retail sales – by New Deal democrat As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy. Nominally, retail sales rose 0.7% in September, and August’s already good 0.6% was revised upward as well. Since consumer inflation rose 0.4%, real retail sales rose 0.3% – still a very good monthly number. Here’s what the past 2.5 years, since the passage of the last big pandemic stimulus look like (blue) compared with personal spending on goods deflated by the PCE goods deflator. Both are normed to 100 as of March 2021: Nominally both usually track close to one another; the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, Retail sales, US EConomics, Vehicle Sales

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

A big jump in motor vehicle sales highlights a good September for retail sales

– by New Deal democrat

As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy.

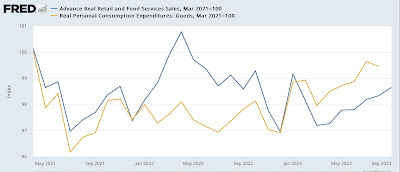

Nominally, retail sales rose 0.7% in September, and August’s already good 0.6% was revised upward as well. Since consumer inflation rose 0.4%, real retail sales rose 0.3% – still a very good monthly number. Here’s what the past 2.5 years, since the passage of the last big pandemic stimulus look like (blue) compared with personal spending on goods deflated by the PCE goods deflator. Both are normed to 100 as of March 2021:

Nominally both usually track close to one another; the difference is in the deflators. Previously it had appeared that the trend for real retail sales remained negative. But with this month’s result and last month’s revisions, both real sales and real PCE’s for goods have been in a clear uptrend this year, resolving a divergence between the two.

As a result, YoY both are now positive, with real retail sales up 0.1%:

Since real sales have a long if somewhat noisy record of leading employment, the above graph also shows the YoY% gains in jobs. The suggestion is that in the coming months the deceleration in jobs grains may stabilize.

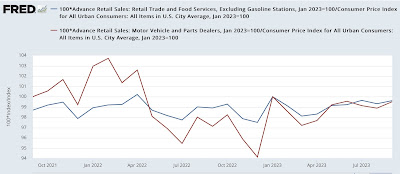

Finally, the improvement in real sales isn’t solely a function of gas prices. Real motor vehicle and parts sales (gold) rose 1.3% in September after a solid gain in August, while real sales ex-gasoline (red) rose 0.7%. The only fly in the ointment is that both are still below their recent January peaks by -0.5% and -0.4% respectively:

Elsewhere I’ve noted that improvement in vehicle manufacturing has been a big counterweight to the decline in manufacturing in other sectors in the past year. Today’s report shows that the improvement in vehicle sales is clearly the biggest single contributor to the positive news about consumer sales this year as well. The un-kinking of pandemic supply chains continues to be a decisive component of the positive economic news this year.

Real retail sales continue to be weak, Angry Bear, New Deal democrat

Vehicle sales, residential, and manufacturing plant construction, Angry Bear, New Deal democrat