Q4 2022 GDP positive, but both long leading components continue negative – by New Deal democrat Here’s my last note for this morning. Real Q4 GDP came in at +0.7%, or +2.8% annualized. While this is lower than most quarters in the past several years, as shown below: Although not shown (due to the huge pandemic swings), it would have been slightly above average for any quarter in the 10 years that predated the pandemic. But as usual, my focus is on the two long leading components in the GDP report: proprietors’ income, a proxy for corporate profits, and private residential fixed investment (housing) as a share of GDP. And the bottom line is, both were negative. Proprietors’ income (blue in the graph below), a proxy for corporate

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Housing Down, politics, Recession 2023 soon, US EConomics, US/Global Economics, Weekly Indicators for December 5 - 9 New Deal Democrat

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Q4 2022 GDP positive, but both long leading components continue negative

– by New Deal democrat

Here’s my last note for this morning.

Real Q4 GDP came in at +0.7%, or +2.8% annualized. While this is lower than most quarters in the past several years, as shown below:

Although not shown (due to the huge pandemic swings), it would have been slightly above average for any quarter in the 10 years that predated the pandemic.

But as usual, my focus is on the two long leading components in the GDP report: proprietors’ income, a proxy for corporate profits, and private residential fixed investment (housing) as a share of GDP.

And the bottom line is, both were negative.

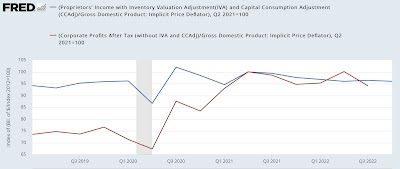

Proprietors’ income (blue in the graph below), a proxy for corporate profits (red), which won’t be reported for another two months, were up +3.2% nominally. The “official” leading metric uses unit labor costs as a deflator, which we also don’t know yet, so I’ve substituted the implicit GDP deflator as a temporary fix:

As deflated, they were down -0.4% for the quarter, and -4.0% since their Q2 2021 peak. Employers who are making less profit start to cut back labor’s hours and jobs, or at least on hiring. In other words, this portends future further weakening of the jobs market.

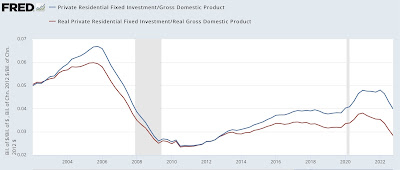

Secondly, real private residential investment as a share of GDP is a long leading indicator popularized over 15 years ago by Prof. Edward Leamer. It tends to turn down 6-7 quarters before a recession hits. It is even slightly more leading when calculated in real inflation-adjusted terms. Unsurprisingly, in Q4 of last year this took another bad hit:

This metric has been screaming “recession!” for several quarters now; just remember that supply constraints mean that housing units under construction made an all time high last month, as reported in last week’s monthly update for December.

This adds even more evidence for the proposition that there will be a recession this year.