Real retail sales continue to suggest recession, decelerating employment gains – by New Deal democrat The second of the three important datapoints this morning was retail sales for May. This is one of my favorite indicators, because it has several leading relationships, and is also an important component of one of the main data series that the NBER looks at in dating recessions. Nominally retail sales for May increased 0.4%. After adjusting for inflation, the increase rounds to 0.2% (blue in the graph below). This remains close to the lowest absolute levels of retail sales in the past 2 years. Because real retail sales correspond closely to real personal consumption expenditures for goods (red), I include that as well: YoY real retail

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Real retail sales continue to suggest recession, decelerating employment gains

– by New Deal democrat

The second of the three important datapoints this morning was retail sales for May. This is one of my favorite indicators, because it has several leading relationships, and is also an important component of one of the main data series that the NBER looks at in dating recessions.

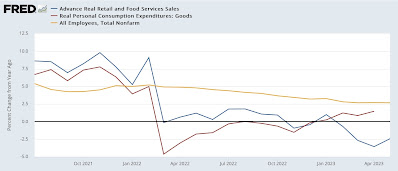

Nominally retail sales for May increased 0.4%. After adjusting for inflation, the increase rounds to 0.2% (blue in the graph below). This remains close to the lowest absolute levels of retail sales in the past 2 years. Because real retail sales correspond closely to real personal consumption expenditures for goods (red), I include that as well:

YoY real retail sales are down -2.4%. In the past 75 years, this has almost always been recessionary. Since it is also a short leading indicator for payroll employment (gold), it implies continuing gradual deceleration in the growth of monthly jobs as well:

Note that I have discounted the big YoY declines last spring, which were in comparison to the 2021 spring stimulus spending spree. The effects of that engorgement are waning.

I suspect that personal consumption expenditures will resolve in the direction of real retail sales, but we won’t know that for 2 more weeks at least.