Despite sharp rebounds in retail sales and manufacturing production, both metrics are on the cusp of being recessionary – by New Deal democrat Retail sales for January rose strongly in January,up 30% in nominal terms and up 2.4% after accounting for inflation. While that looks great, it only reverses the two downward readings of November and December, and is similar to the reversal last January. This makes me think that there is unresolved Holiday seasonality at work. In any event, real retail sales remain -0.8% below their April 2022 peak: Further, as I’ve noted many times, real retail sales going negative YoY, at least for more than one or two months, has been an excellent harbinger of incoming recession. In fact, the relationship goes

Topics:

NewDealdemocrat considers the following as important: Hot Topics, manufacturing, politics, sales, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Despite sharp rebounds in retail sales and manufacturing production, both metrics are on the cusp of being recessionary

– by New Deal democrat

Retail sales for January rose strongly in January,up 30% in nominal terms and up 2.4% after accounting for inflation. While that looks great, it only reverses the two downward readings of November and December, and is similar to the reversal last January. This makes me think that there is unresolved Holiday seasonality at work. In any event, real retail sales remain -0.8% below their April 2022 peak:

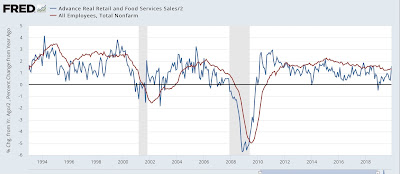

Further, as I’ve noted many times, real retail sales going negative YoY, at least for more than one or two months, has been an excellent harbinger of incoming recession. In fact, the relationship goes back about 75 years. Here is the period from 1993 through 2019::

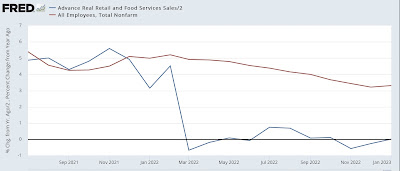

While I’ve discounted the negative numbers from spring 2021 because of distortions due to comparisons with the spring 2021 stimulus months, there is no distortion in those of the last few months since September. Here’s the last 18 months:

For January, YoY retail sales were up less than 0.1%, rounding to unchanged. The last 5 months have been on the cusp of recessionary readings. Further, as the red line implies, nonfarm payrolls should continue to decelerate, despite January’s strong jobs number.

The report on industrial production, the King of Coincident Indicators, was not very different. Total production was unchanged, and is -1.6% below its October peak. Manufacturing production rose a strong 1.0%, but nevertheless is -2.0% below its April peak:

Industrial production, if it were taken by itself, would suggest that we are already in a shallow recession.