Spending soars, income stagnates, savings sink like the Titanic – by New Deal democrat Real life intruded yesterday, so I didn’t put up any information about the Q3 GDP report. I’ll write in detail next week, but in the meantime there were 4 basic highlights: 1. Obviously it was an excellent report overall. 2. The long leading metric of real residential fixed spending also rose slightly, although as a share of real GDP it fell, so technically it was a slight negative. 3. Proprietors’ income also rose, both nominally and after adjusted for inflation, so it was positive. 4. The only other fly in the ointment was the real personal income declined for the Quarter, as to which we got more information in this morning’s report on personal

Topics:

NewDealdemocrat considers the following as important: Hot Topics, income, New Deal Democrat, politics, savings, spending, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Spending soars, income stagnates, savings sink like the Titanic

– by New Deal democrat

Real life intruded yesterday, so I didn’t put up any information about the Q3 GDP report. I’ll write in detail next week, but in the meantime there were 4 basic highlights:

1. Obviously it was an excellent report overall.

2. The long leading metric of real residential fixed spending also rose slightly, although as a share of real GDP it fell, so technically it was a slight negative.

3. Proprietors’ income also rose, both nominally and after adjusted for inflation, so it was positive.

4. The only other fly in the ointment was the real personal income declined for the Quarter, as to which we got more information in this morning’s report on personal income and spending, to wit, below…

This year real personal income and spending have assumed more importance than usual, because as gas and other commodity prices have declined sharply, consumers ramped up spending. That continued in September – but with a very major caveat that consumers have been raiding their savings to do so.

So let me start right out with the personal saving rate, which declined monthly by a sharp -0.6% to 3.4%. Since May the personal saving rate has declined a whopping -1.9%! To put this in perspective, the below graph subtracts 3.4% from the value to show it at the zero line historically:

In the past half century, the saving rate has only been this low in 2005-07 and for most of 2022. This simply cannot be sustained for long.

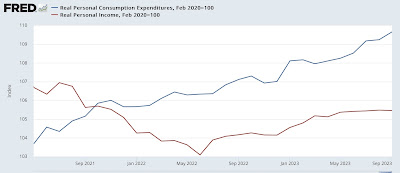

Obviously that money got spent, and in September personal spending rose a sharp 0.7% nominally, while income rose 0.3%. Since PCE inflation clocked in at +0.4%, in real terms (after rounding) spending rose 0.4%, and income was unchanged. The below graph (and all other graphs in this post below) is normed to 100 as of just before the pandemic:

While spending has ramped up all spring and summer, note that real income has flatlined since May. This may be noise, or it may be an early warning of a trend change. We’ll see.

Dividing consumption into spending on goods (which tend to turn first) vs. services shows that both continued strong in September:

Services, as they have almost for the past 50+ years, have risen consistently since the pandemic low. Like so many other items, however, June 2022 was the inflection point for spending on goods, which have risen with some fluctuation ever since. Although I won’t bother with the graph, the YoY% increases are also very robust and not at all recessionary.

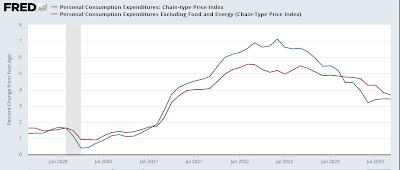

As mentioned above, the PCE deflator increased 0.4% for the month. Here’s what both headline and core PCE inflation look like on a YoY basis since before the pandemic:

Just as with the CPI earlier this month, the core measure has continued to decelerate, to 3.7% while headline iinflation has stabilized, at 3.4%.

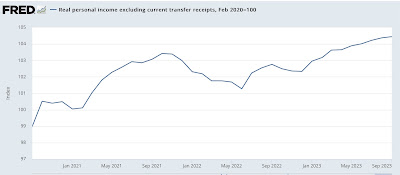

Finally, there are two other metrics contained in this report that the NBER looks at for recession dating. Both were positive.

Real income ex-government transfer payments rose 0.1% to another new high:

And real manufacturing and trade sales (which uses the PCE deflator) rose 0.4% and tied its previous post-pandemic highs:

In short, the good news is that all of the relevant spending indicators came in very positive. The bad news is that real income has stagnated in recent months, and that spending splurge has been fueled by shoveling into savings, a situation which is unlikely to continue for very long.

April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January, Angry Bear, New Deal democrat