Spending soars, income stagnates, savings sink like the Titanic – by New Deal democrat Real life intruded yesterday, so I didn’t put up any information about the Q3 GDP report. I’ll write in detail next week, but in the meantime there were 4 basic highlights: 1. Obviously it was an excellent report overall. 2. The long leading metric of real residential fixed spending also rose slightly, although as a share of real GDP it fell, so...

Read More »Strong personal income and spending – near record low in saving

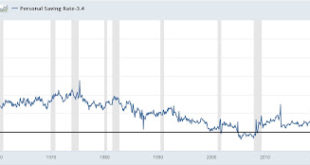

Strong personal income and spending contrast with near record low in saving – by New Deal democrat Like retail sales earlier in November, personal income and spending both rose smartly, as shown in the below graph of real retail sales compared with real personal spending: Real personal income was up 0.4%, and real personal spending increased 0.5%: Nominally each increased 0.3% more; i.e., the PCE deflator was 0.3%. Each metric only had...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »A dent in the surface of time

This chart has been fascinating me for ages. It was produced by the Bank of England to illustrate a speech by Andy Haldane. Shock, horror - we have the lowest interest rates for 5,000 years. Even in the Great Depression they were higher than they are now. These are, of course, nominal interest rates. Real interest rates are even lower - though not by much, since inflation is close to zero in all major economies.Note also the divergence of long-term and short-term interest rates. This is...

Read More »Germany’s negative-rates trap

Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for...

Read More »Internal and external balance of savings and investment

I was recently asked by an Australian economics journal to write a review of a book I had already read, The Leaderless Economy, by Peter Temin and David Vines (published in 2013). Because the book is a great place from which to start a discussion on the links within the global economy, I decided to base this essay on the book. I had already read Peter Temin’s Lessons from the Great Depression (1991), The Roman Market Economy (2012), and Prometheus Unshackled (2013), and I know his work...

Read More » Heterodox

Heterodox