Initial jobless claims: unresolved seasonality obscures cautionary YoY comparisons – by New Deal democrat For the last few weeks, I have been highlighting that there is likely some unresolved post-pandemic seasonality in the initial claims numbers. That certainly looked like the case this week, as a sharp decline mirrored a similar sharp decline 52 weeks ago. To wit: initial claims declined -20,000 to 201,000, the lowest number since February. But exactly one year ago, they declined -5,000 to 192,000, part of a -24,000 monthly decline to a 50 year low of 182,000 on September 24th. The 4 week average this week also declined -7,750 to 217,000, also the lowest since February. And continuing claims, with a one week delay, declined -21,000 to

Topics:

NewDealdemocrat considers the following as important: 2023, Hot Topics, jobless caims, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Initial jobless claims: unresolved seasonality obscures cautionary YoY comparisons

– by New Deal democrat

For the last few weeks, I have been highlighting that there is likely some unresolved post-pandemic seasonality in the initial claims numbers. That certainly looked like the case this week, as a sharp decline mirrored a similar sharp decline 52 weeks ago.

To wit: initial claims declined -20,000 to 201,000, the lowest number since February. But exactly one year ago, they declined -5,000 to 192,000, part of a -24,000 monthly decline to a 50 year low of 182,000 on September 24th.

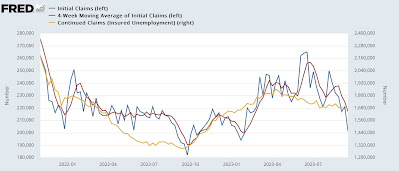

The 4 week average this week also declined -7,750 to 217,000, also the lowest since February. And continuing claims, with a one week delay, declined -21,000 to 1.662 million, the lowest since January:

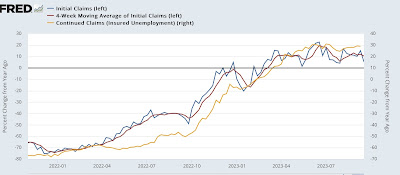

But the YoY% changes make clear the effect of unresolved seasonality. On that basis, weekly claims were higher by 5.2%, the 4 week average by 10.4%, and continuing claims by 28.9%:

The 4 week average being higher by more than 10% YoY is enough to maintain the “yellow caution flag” but not over the 12.5% threshold that, if maintained for 2 months, would warrant a “red flag.”

On a monthly basis, despite the big declines on a weekly basis, so far September is running 11.8% above last year:

.That suggests that the unemployment rate over the next few months is likely to trend towards 3.9%-4.0% (1.118*3.6%, the average unemployment rate in summer and autumn last year). The “Sahm Rule” for recessions would only be triggered by an average unemployment rate of 4.0% or higher this coming winter, which would be 0.5% higher than last winter’s average of 3.5%