Strong upward revisions push real personal income to new highs, put 2 important coincident indicators firmly in expansion territory – by New Deal democrat Almost all of the news in this morning’s release for personal income and spending for January was positive. Nominally, personal income rose +0.6% and personal spending rose 1.8%. The deflator also rose +0.6%, making real personal income close to unchanged, and real spending (after rounding) up 1.1%. But that wasn’t the biggest news. There were major upward revisions to real personal income in the past 6 months. The below graphs show the former values (blue) vs. the current revisions (red): What had looked like moderate growth in real personal income suddenly looks very strong (once

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, personal income, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Strong upward revisions push real personal income to new highs, put 2 important coincident indicators firmly in expansion territory

– by New Deal democrat

Almost all of the news in this morning’s release for personal income and spending for January was positive.

Nominally, personal income rose +0.6% and personal spending rose 1.8%. The deflator also rose +0.6%, making real personal income close to unchanged, and real spending (after rounding) up 1.1%.

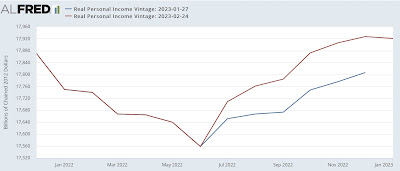

But that wasn’t the biggest news. There were major upward revisions to real personal income in the past 6 months. The below graphs show the former values (blue) vs. the current revisions (red):

What had looked like moderate growth in real personal income suddenly looks very strong (once again: a big decline in gas prices can work wonders for inflation-adjusted data!).

This affects one of the coincident indicators used by the NBER to calculate if a recession has begun, real personal income less transfer receipts:

Again, what looked like tepid growth or even a YoY stall now looks strong.

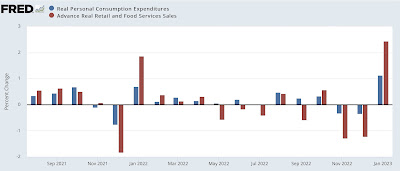

There were only minor revisions for the last several months to personal consumption expenditures, making December -0.2% lower than previously reported. Still, the big growth in January took real personal spending to its highest level ever. As I’ve previously noted, personal spending is like the opposite side of the transaction from real retail sales. Here’s what the monthly changes in each look like for the past 18 months:

Both had an extra dose of seasonality, as big declines in November and December were offset by big increases in January.

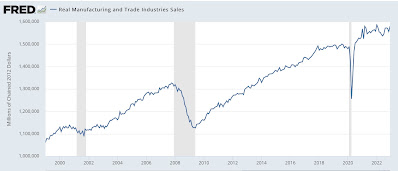

The good news also applied to real manufacturing and trade sales for December. This which was updated this morning as well, jumping 1.5% for the month to an all time high except for March 2021 and January 2022:

This is also one of the coincident indicators tracked by the NBER, which means that both of them are at the moment firmly in expansion territory.

The only negative in this morning’s report was that the personal saving rate increased 0.2% to 4.7%:

While that’s good for individual households, due to the paradox of saving it is bad for the economy. When in the aggregate consumers save more, they spend less, which is a negative for the economy as a whole. As the above graph shows, typically as expansions go on, consumers save less. Then, as financial conditions like interest rates worsen, they tighten their belts and save more. That’s what we are seeing now.

Good news and bad news on personal income and spending, Angry Bear, New Deal democrat