Scenes from the leading sectors of the December jobs report: sectors of weakness and strength – by New Deal democrat For nearly two decades, my focus on economic reporting online has been finding and examining leading indicators; those datapoints that tell us where the economy in general, and in particular jobs and income for ordinary Americans, are heading in the near future. Usually that has meant batting away DOOOOMers; those people who always see terrible things dead ahead, usually based on an indicator they never mentioned before, and will never mention again once its forecast fails to come to fruition. But by the end of 2022, like for most forecasters, for me the stars appeared to be in alignment: something bad was indeed ahead.

Topics:

NewDealdemocrat considers the following as important: 2023, December jobs report, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Scenes from the leading sectors of the December jobs report: sectors of weakness and strength

– by New Deal democrat

For nearly two decades, my focus on economic reporting online has been finding and examining leading indicators; those datapoints that tell us where the economy in general, and in particular jobs and income for ordinary Americans, are heading in the near future.

Usually that has meant batting away DOOOOMers; those people who always see terrible things dead ahead, usually based on an indicator they never mentioned before, and will never mention again once its forecast fails to come to fruition.

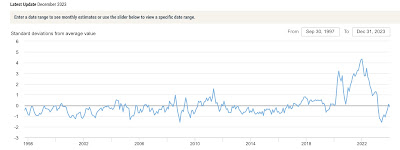

But by the end of 2022, like for most forecasters, for me the stars appeared to be in alignment: something bad was indeed ahead. But then something akin to the reverse of THE GREAT FLAMING METEOR OF DOOM! happened: the unspooling of pandemic-related supply bottlenecks more than overcame the effects of the most stringent series of Fed rate hikes in 40+ years. For reference, here is the NY Fed’s Global Supply Chain Pressure Index for the past 25+ years:

Supply chain pressures were at their all-time highest in December 2021. They completely abated by February 2023, and were tied for their all-time loosest last May. In December they were very slightly tight, and in January reverted to very slightly loose – in other words, within their normal long term range.

So, what happens now? Does the improvement in interest rates recently mean better times ahead, or does the fact that they remains very elevated compared with two years ago mean that the tightening finally takes effect? We are in uncharted waters.

All of which is by way of introduction to the short leading indicators for employment constrained in the jobs report. One month ago I wrote that the leading internals of the report were much weaker than most commentators highlighted.

Let’s see what happened with the December report. Last month I compared present data with long term trends. This time around I’ll use shorter term graphs, but here’s a link to the post one month ago in case you want to compare with longer term trends.

The leading data within the jobs report focuses on the manufacturing and construction sectors, the transportation bringing those goods to market, whether layoffs are increasing or not, and temporary help. That’s because service jobs generally are only affected substantially after jobs in the goods-producing, and transporting, sector are hit.

The first metric to suffer – reliably enough that it is one of the 10 “official” leading indicators – is the manufacturing workweek. This declined to 40.4 hours in December, its first time below the modern 40.5 hour threshold that has meant contraction, and 1.2 hours below its post pandemic peak:

Only once in the past 75 years, in 1967, has a decline this much not occurred without a recession following shortly, if we were not already in one.

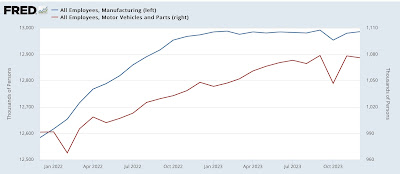

Manufacturing employment itself has almost always declined before the onset of a recession. For the past year, by contrast, it has been almost completely flat (blue). A significant positive has been the increase in motor vehicle production jobs, as the supply chain in that industry has unspooled (red, right scale). That segment might be peaking:

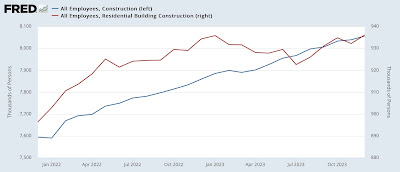

A somewhat similar dynamic has played out in construction, as residential construction employment (building houses) declined through most of 2023, before rising again to a new post-pandemic high in December; while total construction employment (led by the building of new on-shore manufacturing plants) has continued to increase throughout:

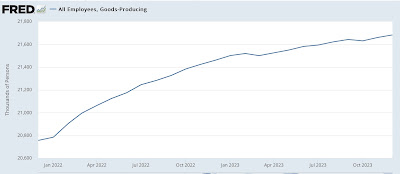

All of this has helped goods employment in total, which typically has rolled over or at least plateaued before a recession, continue to grow:

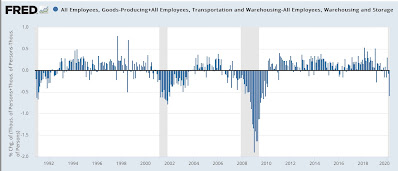

All goods produced, whether domestic or foreign in origin, must be hauled to market. Unsurprisingly, transportation employment (especially trucking) in the past has also typically turned down before a recession. Both of these peaked last May:

Like manufacturing – but unlike construction – transportation shows signs of rolling over.

Here’s what the monthly % change in goods-producing jobs + transportation jobs looks like for the 30 years before the pandemic:

And here it is for the past 2.5 years:

Not quite recessionary, but definitely weak.

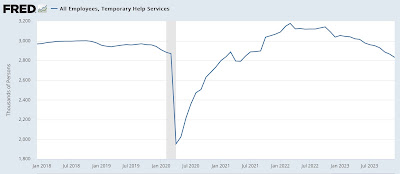

Temporary help has probably also been distorted by the pandemic, as it surged well into record territory in late 2021, but has now sunk down below its immediate pre-pandemic level:

I think I would put more weight on its recent (as in, last 6 month or so) decline compared with the backing off from record levels in 2022.

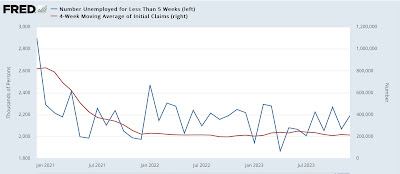

Finally, whether or not layoffs have been increasing is shown by short duration (i.e., less than 5 weeks) new unemployment (blue). Typically (but not always!) these have increased for 6 months or more before a recession has begun. The series is noisier than initial jobless claims (red, right, averaged monthly) and thus it has largely been supplanted by them:

The 3 month average trend in short term unemployment has increased a little in the past 5 months, but is well within the range of noise.

In summary, we have a very weak manufacturing sector, as well as the transportation sector hauling those goods to market. This is counterbalanced by a still-strongly growing construction sector. There are further signs of weakness in the downturn in temporary hiring, and an equivocal, and noisy, slight uptick in short term unemployment.

The more interest rates cooperate, the less likely this weakness will turn into an actual downturn, and the more likely we’ll see increasing strength.

Scenes from the leading sectors of the November jobs report: why I sounded a note of caution, Angry Bear, by New Deal democrat.