Dean is on a roll here with propositions for the nation as it ages. Thoughtfully, I called it initially a Quiver of Arrows in Support of the economy and in the end Social Security. He is answering a question of what do we need to do to prepare for an aging population and lower replacement rates. We may not need to do as much as we think. By the way this post is a follow up to Dale Coberly’s post; Social Security Trustees’ Report Is Out So Is...

Read More »Social Security Trustees’ Report Is Out So Is CRFB’s Analysis

Social Security Trustees’ Report Is Out So Is CRFB’s Analysis by Dale Coberly Look, I don’t like CRFB. They claim to be the Committee for a Responsible Federal Budget (CRFB), but in the years I have been watching them they have looked more like the Committee to Cut Social Security. Today my inbox presented me with a note from CRFB on this year’s Trustees Report. As far as I can tell CRFB is telling the truth here, strictly speaking. ...

Read More »A Betrayal of America

Lets get this out of the way first; Speaker 1 is Charlie Sykes of “The Bulwark Podcast“. Speaker 2 is former Federal Judge Michael Luttig. The talk and the partial transcript is about trump and the events leading up to January 6 starting 2 days before the attempt. As I read through the entire Transcript, I would call it “a “what do or did you know and when did you know it” interrogation. “The question to be asked is could the January 6th...

Read More »Revisions to Q4 GDP made real final sales worse

Revisions to Q4 GDP made real final sales worse, a potential portent of near in time recession – by New Deal democrat A month ago, following another blogger, I took a look at real final sales, and real final sales to domestic purchasers, in the GDP – which increased less than 0.5% and just above 0% in Q4, and showed that in the past 60 years, only in the deep slowdowns of 1966 and 1987 were the numbers that low without having been followed...

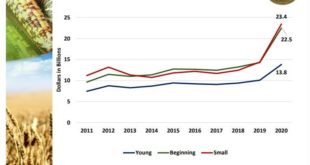

Read More »Death to Farm Credit from Those on High

I think I missed this one by Michael Smith. I did not delete it out of my In-Box/ Even so it is interesting . . . Death to Farm Credit from Those on High, Farmer and Economist, Mike Smith I’m in between fall crop planting and have to focus so I am going to run this like the rancher on the clock. Farm Credit System History In 1916 when the Farm Credit System was established there were 6 million farms that employed around 30% of the US...

Read More »Response Would’ve Been ‘Vastly Different’ if the Rioters Were Black

I was no general, field grade officer, or even an officer in 1970. Just a three-strip Sergeant in my 3rd year stationed at Lejeune drinking the water and bathing in it. Someone had a brilliant idea we should be trained in riot control since Camp Lejeune was not far from Washington D.C. Some elements out of Fort Bragg would join us. As we were Federal soldiers, our facing civilians is frowned upon. In any case, we were trained, never called...

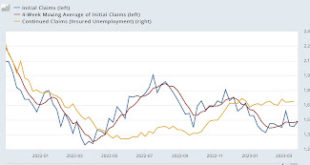

Read More »Almost nobody is still getting laid off, but this week, it’s not good enough

Almost nobody is still getting laid off, but this week, it’s not good enough – by New Deal democrat Today and tomorrow update the two remaining positive sectors of the economy: jobs and real personal income. And the first one continued to give excellent historical readings, but relatively speaking suffered in comparison to their all-time best readings from exactly one year ago. Initial jobless claims rose 7,000 to 198,000, while the more...

Read More »Door Wide Open for Republicans on Student Loans

Door Wide Open for Republicans on Student Loans, Alan Collinge, Student Loan Justice, Medium. Angry Bear has featured Alan and Student Loan Justice Org. well over a decade now. In the manner they are written, these loans by the Federal Government and maintained by private enterprises are akin to loans made by a hypothetical student loan shark. Loan relief exists for every other loan in this nation. Just not for Students. There are about 54...

Read More »UK National Health Service Failures Due to Privatization & Funding Cuts

What we are seeing in the UK is an example of giving commercial healthcare too much latitude in providing healthcare. Private equity became involved with care for older people and care became chargeable and means-tested, long-stay hospitals were closed. and the government gave over the building of new facilities to private interests. Th US is just starting to experience the growth of mega-healthcare corporations having tenacles in the lowest...

Read More »Sharp deceleration in YoY house price gains, and the Fed’s chasing the phantom menace

More on the sharp deceleration in YoY house price gains, and the Fed’s chasing the phantom menace – by New Deal democrat Since there is no big economic news again today, let me fill in a little more detail on house prices through January, reported yesterday, vs. CPI for shelter. Here is the monthly % change for the past 18 months for Owners Equivalent Rent in the CPI (blue), vs. the Case Shiller national index (gold) and the FHFA purchase...

Read More » The Angry Bear

The Angry Bear