Read More »

The increasing trend in new jobless claims continues

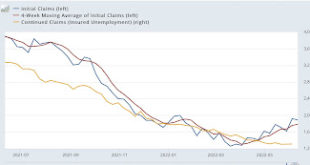

The increasing trend in new jobless claims continues Initial jobless claims declined -3,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose 2,750 to 218,500, compared with the all-time low of 170,500 ten weeks ago. Continuing claims rose 3,000 to 1,312,000, or 6,000 above their 50 year low of 2 weeks ago: It’s now clear that initial claims have been in an uptrend over the past 2.5 months. If...

Read More »Vaccines? Focused protection? Not if you ask the fine libertarians at the Brownstone Institute.

Pre-COVID, who would have thought that a significant part of the libertarian thought collective would go anti-vax? Not me. But I stand corrected. From a recent blog post at the illustrious Brownstone Institute: The people whose directives you are following talk a lot about “pseudoscience,” always accusing those of us who disagree with their directives of pushing it. But you know what pseudoscience actually is? It’s putting forth a premise that...

Read More »Negative May and YoY real retail sales add to the foreboding signals of a recession next year

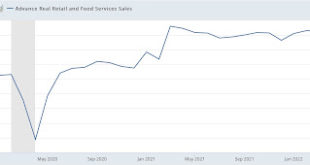

Negative May and YoY real retail sales add to the foreboding signals of a recession next year Nominal retail sales for the month of May declined -0.3%, and April was revised down by -0.2% to +0.7%. This reduces April’s number, after inflation to +0.4%, followed by a “real” decline in May of -1.2% after rounding. YoY real retail sales were up 8.1%, but because inflation in the past 12 months has been 8.5%, real retail sales YoY is down -0.4%. Here...

Read More »Pence’s Letter of Explanation Written on January 5th

As taken from “Letters from an American,” June 12, 2022, Prof. Heather Cox Richardson “Yesterday, Politico’s Betsy Woodruff Swan and Kyle Cheney reported on January 5, 2021, then – vice president Pence’s attorney Greg Jacob wrote a three-page memo concluding what the president and his supporters were demanding Pence do the next day would break the 1887 Electoral College Act—that is, the law – in four different ways. The memo responded to John...

Read More »April Trade Deficit Decreases on Lower Imports

RJS: MarketWatch 666 ~~~~~~~~ Summary: April Trade Deficit Decreased by a record 19.1%, Led by Lower Imports of Consumer Goods and Industrial Supplies and Materials ~~~~~~~~ Our trade deficit was 19.1% lower in April, as our exports increased while our imports decreased. The Commerce Dept report on our international trade in goods and services for April, incorporating an annual revision, indicated that our seasonally adjusted goods...

Read More »Farming With a Tesla

Texas is big. To frame how big, let me contextualize the normal travels for a rural resident in a few touch points that are universal. The closest large city with a decently large grocery store and a Home Depot are 37 miles one way. When running an “errand” it is easy to tack on 100 miles to the odometer in just a few hours. The parents are 42 miles away in the next city “down the highway” as it were. Sister in law 92 miles, brother 121 miles, Tesla...

Read More »Auto and Light Truck Emission Rules are Still Problematic

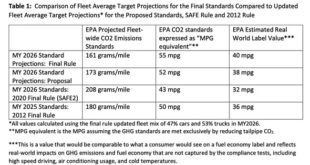

“New Auto Emissions Rules Have a Loophole You Can Drive a Light-Duty Truck Through” (treehugger.com), Lloyd Alter, December 2021 ~~~~~~~~ President Biden and the U.S. Environmental Protection Agency (EPA) have revised the existing greenhouse gas emissions standards for passenger cars and light-duty trucks. Rolling back in four years the rollbacks the Trump administration implemented to change the standards set in place by the Obama...

Read More »What Mo Said

All this we’ve been hearing about the sanctity of the Second Amendment? Seems that what the Second really means is that Americans have the right to buy assault weapons to use to exercise their right to overthrow the government. That big surge in AR-15 purchases after the election of Barack Obama? Turns out that it wasn’t about defending the purchasers from criminals after all. It was about arming a well-armed militia that could overthrow the US...

Read More »Missing all the fun on Wall Street . . .

On the road, and missing all the fun on Wall Street . . . I’m still on the road, and there is no important economic statistic to report, but I will make a brief market comment. YoY stocks are now down 10%. Except for the very bad 1982 and 2008 recessions, and the 2000 Nasdaq bubble and the 1987 crash (which were prolonged bear markets), that has typically been close to their YoY lows: And with rare exception that level has only been hit...

Read More » The Angry Bear

The Angry Bear