RJS, MarketWatch 666 Summary: Producer Prices Rose 1.4% in March, Annual Increase at 11.2%, with Goods Up 15.7%, Services Up 8.7%, All Record Highs The seasonally adjusted Producer Price Index (PPI) for final demand rose 1.4% in March, as average prices for finished wholesale goods rose by 2.3% and final demand for services rose 0.9% . . . that increase followed a revised 0.9% increase in February, when average prices for finished wholesale...

Read More »Rapid 2020 Recovery, Faster than Previous Recoveries

Coming from a different source of information . . . Employ America emphasizes a rapid recovery in 2020 as measured from a pre-recession peak till now. If you recall the 2008 recovery after Wall Street and banks were faltering was by far longer. In this case, we are looking at a Covid inspired period of layoff as compared to previous recessional layoffs. Due to Joe Biden programs and the support of Dems, the nation and labor’s 2020 recovery...

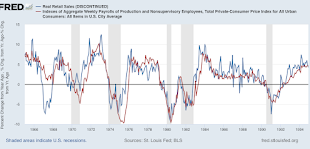

Read More »Real aggregate payrolls and sales

Real aggregate payrolls and sales There seems to be some pushback against the narrative that real wages have declined, based on compositional effects (lower pay occupations vs. higher pay occupations). While some of that is true (for example, 5/6’s of all leisure and hospitality losses have been recovered, vs. 3.4% actual job *gains* since February 2020 in professional and business services; and a 91% rebound among total payrolls) – it is far less...

Read More »Less Oil Production and Higher Gasoline Prices, Why?

Why Less Oil Production and Higher Gasoline Prices? I mean the obvious answer is Demand is outstripping Supply. Oil companies and refineries are not the charitable type either. No oil/natural gas pipeline would have helped either. Digby had the answer up on Hullabaloo (15th) which I read first so credit goes there first. Digby did reference Dean Baker at CEPR (14th) which I am reading right now to add his comments momentarily. And we do have...

Read More »The production side of the economy remained solid in March

The production side of the economy remained solid in March Industrial production, the King of Coincident Indicators, increased in March by 0.9%. February was also revised higher by 0.4%, but January was revised lower by the same percentage, for a wash. Manufacturing production also increased 0.9%. Total production thus made another new record high, while manufacturing is still below its record levels of 2007 and early 2008: On a YoY basis,...

Read More »Happy Easter & Hello Spring

For those up north in the hinter lands of the US. Nineties today in AZ and more of the same tomorrow. Have some dinner with family, friends, and take in a stranger too. Give to those who need help. Practice the religion of your choice, if you have one you favor. Say hello to neighbors. Color some eggs. Easter baskets for the kids. Enjoy some marshmallow bunnies, a bunch of jellybeans, and chocolate rabbits. And above all, be safe. If you...

Read More »Of a Time

“Because, that is just the way it is,” we are told. The ‘way it is’, for sure, but that doesn’t mean that it is how it should be. Or, we hear, “Because, that is the way it has always been.” It’s too late to change the ‘always has been’ part, but just because we have always done something a certain way doesn’t mean that is how it should be done. The proper response to both of the two axioms is, “How should it be?” A third reason/axiom often proffered...

Read More »Real retail sales in March continue to show a weaker consumer sector, forecast weaker jobs reports

Real retail sales in March continue to show a weaker consumer sector, forecast weaker jobs reports For the past few months, I have suspected that a sharp deceleration beginning with the consumer sector of the economy was more likely than not. The retail sales report for March was consistent with that suspicion. Nominally retail sales rose +0.5% in March, but since consumer prices rose 1.2%, real retail sales declined -0.7%. Further, they are...

Read More »Stacking the Deck Against Vets

The same as turning Medicare over to commercial healthcare, having a nine-member panel and a critic of the VA in charge does not bode well for Veteran Healthcare. Denis McDonough is not a veteran and it is hard to imagine how he would relate to many of us. Senators Joe Manchin and Michael Rounds penned a letter to President Joe Biden, enjoined by other senators in a bipartisan request to maintain quality veteran care across the nation in VA...

Read More »The libertarian information filter, vaccine hesitancy, and the “focused protection” con

On February 11, 2022, Faye Flam published an opinion piece in Bloomberg titled “Mask Mandates Didn’t Make Much of a Difference Anyway.” The subhead was “The policies clearly didn’t stop omicron. Let’s focus on tactics that have worked better.” The headline is somewhat misleading. Flam acknowledges that masks may be beneficial, especially high-quality masks, and she quotes an expert who supports masking when cases are high and vaccination rates...

Read More » The Angry Bear

The Angry Bear