A broad topic (at least it is close to the field in which I am most nearly expert). I am going to write about policy to deal with the economic effects of the Covid 19 epidemic. There has already been an amazingly quick and huge policy response, which generally seems fairly well designed (with different reasonable approaches in different countries). Also there is, of course, an active discussion of what remains to be done and what could have been done...

Read More »Meanwhile the Republican agenda is being pushed

(Dan here…Best to go there for the content. And Trump is only one of many. One could add pipelines as an issue. Who is coordinating this onslaught while we are pre-occupied?) Via Tom Dispatch : …the latest piece by TomDispatch regular Karen Greenberg, author most recently of Rogue Justice: The Making of the Security State, on the many ways in which what may be a pandemic for the rest of us is proving to be the perfect moment for The Donald when it...

Read More »The Coming Debt Crisis

by Joseph Joyce Joseph P. Joyce is a Professor of Economics at Wellesley College, where he holds the M. Margaret Ball Chair of International Relations. He served as the first Faculty Director of the Madeleine Korbel Albright Institute for Global Affairs. The Coming Debt Crisis After the 2008-09 global financial crisis, economists were criticized for not predicting its coming. This charge was not totally justified, as there were some who were...

Read More »Wisconsin Votes Today Regardless of COVID 19

Curbside Voting Information – Wisconsin – Election Day, Tuesday, April 7 – All Absentee Ballots must be postmarked TODAY or dropped off in-person. In this order, a decision came hours after the Wisconsin Supreme Court overturned Gov. Tony Evers’s (D) executive order to postpone Tuesday’s vote, sowing confusion in a critical election featuring a Democratic presidential primary and a pivotal state Supreme Court seat. A Monday night SCOTUS decision ruled...

Read More »Hydroxychloroquine and Covid 19 Update

Given Donald Trump’s enthusiastic participation, the debate on hydroxychloroquine and Covid 19 has become very heated. As I wrote here I agree with Trump. This is unusual (not unique he and I both advocating cutting interests rates long ago before the Fed Open Market Committee cut them to 0-0.25 again). My view (and as far as I can make sense of anything he says his) is that it is wise to prescribe hydroxychloroquine for patients with Covid 19 even...

Read More »Open thread April 7, 2020

Trump’s blame-avoidance is politically shrewd

Trump’s handling of the Covid-19 pandemic is predictably chaotic, vengeful, irresponsible, and impulsive. His actions have worsened the epidemic, they have led to unnecessary deaths and to a very painful economic lockdown. Coming in the year before he is up for re-election, this seems self-defeating: if Trump could re-run history I have little doubt he would take aggressive action to nip the epidemic in the bud. That said, the political strategy that...

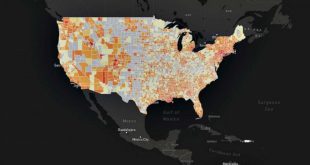

Read More »Emerging hotspots

Adding to Run’s post on rural hospital closings comes this information on rural areas and coronavirus (ABC news) Dr. Marynia Kolak is the assistant director for Health Informatics at the Center for Spatial Data Science at the University of Chicago, which recently released a U.S. COVID-19 Atlas, providing county-level data on COVID-19 cases to help locate emerging hotspots for the disease. The results are surprising. … “A lot of hotspots are seen in rural...

Read More »Coronavirus dashboard for April 5: mandatory lockdowns start to work

Coronavirus dashboard for April 5: mandatory lockdowns start to work by New Deal democrat Here is the update through yesterday (April 4) I’ve changed the format, moving the “just the facts, ma’am” data to the top, and comments to the end. The four most important metrics are starred (***) below. Number and rate of increase of Reported Infections (from Johns Hopkins via arcgis.com) Number: up +33,787 to 312,245 (vs. +32,857 on April 3) ***Rate of...

Read More »Remdesivir III

I told you so on March 2 2020 The first Covid 19 case diagnosed in New Jersey Around 3 a.m. on March 10, Balani arrived at the hospital. The medicine had come in, and she did not want to wait until the morning to administer it. With Balani in the room, a nurse woke Cai up so that he could sign the legal papers. Soon after, he was hooked up, intravenously, to the drug. The next day Cai’s fever, which he’d had for at least nine days, finally broke. Even...

Read More » The Angry Bear

The Angry Bear