Protecting Healthcare Workers from Infected Patients, United States vs South Korea Seattle: Korea: Those bedsheets will do a great job preventing the virus from spreading.

Read More »Open thread March 3, 2020

Novel Coronavirus and Better Unsafe than Sorry

It is possible that a known pharmaceutical called remdesivir inhibits the reproduction of the Covid-19 coronavirus. It inhibits (some) RNA dependendent RNA Polymerases — the type of enzyme the virus uses to replicated its genome and express its genes. It is known that it is a potent inhibitor of the RNA dependendent RNA Polymerases used by the MERS coronavirus update: here is a good site for Covid-19 data. So what will be done with remdesivir ? What...

Read More »Weekly Indicators for February 24 – 28 at Seeking Alpha

by New Deal democrat Weekly Indicators for February 24 – 28 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. What happened in the past week certainly fits the definition of a crash – a loss of more than 10% in just five days – in my mind anyway. Not just stocks, but commodities also crashed. Perhaps surprisingly, in the “hard” data of actual production and consumption, there doesn’t seem to have been much of an impact. In any event,...

Read More »Atlanta and downstream friends

(Dan here…another of David Zetland’s students Johanna writes on groundwater…a reminder of what also matters during this heated political climate, and from a younger generation. The first mention of water wars at AB was 2007 I believe.) Atlanta and downstream friends Johanna writes* This post offers some insight into the problems of water management in Atlanta (the capital of Georgia) and the effects of those problems on its downstream neighbors Florida...

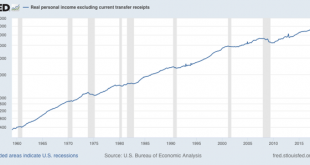

Read More »January real personal income consistent with either slowdown or incipient recession

January real personal income consistent with either slowdown or incipient recession Real personal income (less government transfers) is one of the four coincident indicators the NBER looks at in determining recessions. Since January’s numbers were reported this morning, let’s take an updated look. Truth be told, real personal income is actually a short lagging indicator. It frequently continues to improve a few months into a recession – and...

Read More »psst… the fundamentals are strong

Conversational Points about Coronavirus and Administration Answers

Newcastle ban handshakes at training ground: “There’s a ritual here that everybody shakes hands with everybody as soon as we see each other every morning,” said Bruce as he prepared for Saturday’s game against Burnley at St James’ Park. “But we’ve stopped that on the advice of our club doctor. Thankfully, we’ve got a superb doctor here and he will keep us informed of what we have to do. We’re like everybody else, we’re glued to the TV for where it’s going...

Read More »Housing: prices follow sales, February 2020 edition

Housing: prices follow sales, February 2020 edition One of the consistent things I have written about the housing market for going on 10 years is that interest rates lead sales, and sales in turn lead prices. Last week with the continued increase in housing starts and permits we got further proof of the former, and this morning with the release of several house price indexes, we got further proof of the latter. Below I show the FHFA house price index...

Read More »A threatened groundwater source

(Dan here…one of David Zetland’s students Lenaide writes on groundwater…a reminder of what also matters during this heated political climate, and from a younger generation) A threatened groundwater source Lenaide writes* Imagine living in a city located on top of the largest groundwater source and longest river in France, but to also have both of these sources be under the threat of scarcity. That it is the current state of Beaugency, France. Beaugency...

Read More » The Angry Bear

The Angry Bear