Are We Living In The “Capitalocene”? I also attended the last session listed in the program at the ASSA at 2:30 on Sunday, an URPE session on “Ecology, the Environment, and Energy,” chaired by Paul Cooney. He presented on “Marxism and Ecological Economics: An Assessment of the Past, Present, and Future.” Lynne Chester presented on “Energy and Social Ontology: Can Social Ontology Provide Insight?” Finally Ann Davis presented on “”‘Home on the Range:’...

Read More »January’s reports start out with a decidedly mixed picture for 2020

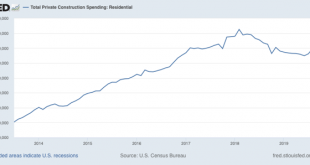

January’s reports start out with a decidedly mixed picture for 2020 We have our first bits of forward-looking data for the year: November residential construction, December ISM manufacturing, and December light vehicle sales. They paint a decidedly mixed picture. Let’s take a look in order. Residential construction spending improved by a strong 1.9% in November. Further, October, which had originally been reported as a decline, was revised to a 0.7%...

Read More »Might We Be On The Verge Of An “Upswing”?

Might We Be On The Verge Of An “Upswing”? One of the more dramatic sessions at the just-completed ASSA meetings in San Diego was an AEA panel on “Deaths from Despair and the Future of Capitalism” on Saturday at 2:30. Chaired by Angus Deaton, it focused on the book by him and his wife/coauthor Anne Case with the same title as the panel session. Case spoke on their book. This was followed by Robert Putnam, who spoke on his forthcoming (in about six...

Read More »State Capacity and Liberalism

State Capacity and Liberalism Tyler Cowen has a post up on State Capacity Libertarianism. I’m not so interested in the “libertarian” part of his argument, which is mostly aimed at persuading libertarians to accept some role for government beyond enforcing contracts and protecting property rights. But liberals (as in progressives) have good reason to think hard about state capacity. A few thoughts on liberalism and state capacity: Recognition of...

Read More »Weekly Indicators for December 30 – January 3 at Seeking Alpha

by New Deal democrat Weekly Indicators for December 30 – January 3 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. There were marginal moves to the downside on both the producer and consumer sides of the ledger this past week. As usual, clicking over and reading rewards me with just a little bit of $$$ for my efforts.

Read More »Open thread Jan 7, 2020

Pharma Price Increases 2020

As reported by Market Watch and Axios, drug prices are on the rise the beginning of 2020. The increases exceed the 2% inflation the nation has been incurring and the 3.4% growth in wages recently incurred by nonsupervisory labor. According to Market Watch, overall drug pricing will rise 5.8% at the start of 2020 due to price increases. This is about the same as Medical CPI. Fortune Magazine; “The price hikes are almost all below 10%, with the median price...

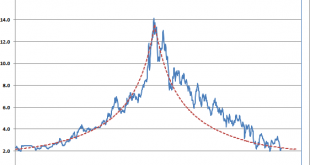

Read More »Long Bond Yields vs The Long Wave

Different bloggers have been posting their favorite charts of 2019 this January. So I decided to post my favorite chart of the past 20, or more, “years of the long bond yield versus the long run trend.” Bond yields are now below their long run trend and may be at or near a secular bottom. Of course no one rings a bell at the turning point so we probably will only identify the bottom long after it actually occurs....

Read More »Republics and the war-making power

Republics and the war-making power In view of the militry carrying out Trump’s order to kill an Iranian general, I thought I would weigh in on the issue of the war-making power historically by republics. I don’t have much to add to the substance of the immediate debate. Killing an Iranian general was certainly an act of war. It was also a big escalation on the US side. At the same time, the US’s economic blockade of Iran, which it has been attempting to...

Read More »Is The Chinese Economic System the “Mandarin Growth Model” or the “Chinese-Style Keiretsu System”?

Is The Chinese Economic System the “Mandarin Growth Model” or the “Chinese-Style Keiretsu System”? The first term in this choice was the title of a paper presented this morning (1/4/20) at the ACES/ASSA session at 8 AM in San Diego by Wei Xiong of Princeton University. It was a highly mathematical model I shall describe shortly, but which drew heavily on the paper presented before it by Chenggan Xu of Cheng Kong Graduate School of Business in Beijing,...

Read More » The Angry Bear

The Angry Bear