Many liberal Democrats vote for the more moderate candidates in primaries, because they think half a loaf is better than none. The claim is that to win in the USA (or any first past the post system) you have to capture the middle. This is based on silly theory which requires the assumption that the set of eligible voters and the set of people who actually vote are the same. The contrasting view is that the key issue is getting people who might or might...

Read More »The consumer / employment sector of the economy continues powering along

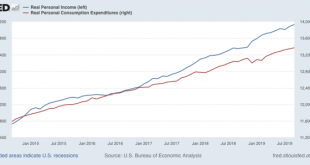

The consumer / employment sector of the economy continues powering along ….. aaaaand, I’m back. Did you miss me? Here is the essence of my view of the economy right now: 1. The producer sector of the economy is struggling, partly due to higher interest rates in the last two years filtering through the system, and partly due to stupid and irrational trade wars. 2. The consumer + employment sector of the economy, on the other hand, is moving right along,...

Read More »Open thread Nov. 1, 2019

DC Circuit grants Postal Watchdog’s challenge to PRC’s approval of rate hike on Forever stamps

An introduction to Save the Post Office and Steve Hutkins. I am not quite sure how I got to Steve; but, I do remember chatting with Mark Jamison who also wrote at Save the Post Office and posting his words up at Angry Bear (Asking the Wrong Questions: Reflections on Amazon, the Post Office, and the Greater Good earlier this year. Mark and I still exchange emails and I owe him a trip out to western North Carolina. Steve is the blog owner, a Prof. of...

Read More »The Death Of Abu Bakr Al-Baghdadi And Related Matters

The Death Of Abu Bakr Al-Baghdadi And Related Matters The self-proclaimed “Caliph” of Da’esh/ISIL/ISIS, Ibrahim Ali al-Badri al-Samarri, who took the name Abu Bakr al-Baghdadi, has blown himself up after US special forces successfully attacked his compound in Idlib province of Syria near the Turkish border after a US military dog attacked him. (His nom de guerre was chosen for its links to historical caliphs, the leaders of global Sunni Islam after the...

Read More »Georgetown University Report Finds Number of Uninsured Children Now at Highest Levels –

Since Major Provisions of Affordable Care Act Took Effect Key Findings: The number of uninsured children in the United States increased by more than 400,000 between 2016 and 2018 bringing the total to over 4 million uninsured children in the nation. These coverage losses are widespread with 15 states showing statistically significant increases in the number and/or rate of uninsured children (Alabama, Arizona, Florida, Georgia, Idaho, Illinois, Indiana,...

Read More »Open thread October 29, 2019

Republican Renegade Emulates Warren’s Student Loan Cancellation, but it’s Still Problematic

Today we have a commentary by Student Loan Justice Organization Founder Alan Collinge with support from an Angry Bear editor. Alan: A key Republican Education Department official and Trump Appointee, A. Wayne Johnson, recently resigned his position at the Department and later made a radical call for student loan cancellation. Johnson noted the lending system was “fundamentally broken” and called for loan cancellation for all loan holders up to $50,000....

Read More »Looking for additional editor for Angry Bear

Dear Readers, Commenters, and Bears, Bill and I are looking for an additional editor: a participant in running the Angry Bear site and interact with contributors and readers to encourage responses and moderate threads as administrator add consistent points of view in posts and finding topics to supplement contributors efforts, become knowledgeable with the administration of our site ranging from problem solving WordPress to registrations like Go-daddy,...

Read More »To Be Sure Jennifer Senior

(Dan here…lifted from Robert’s Stochastic Thoughts) by Robert Waldmann To Be Sure Jennifer Senior I just read an op-ed by Jennifer Senior. I am not 100% satisfied. To be sure, she denounces the Republican Party in no uncertain terms. The op-ed is not completely Balanced. However, old habits die hard. The op-ed contains a good bit of nonsense. Some of it is there to give the essay a beginning a middle and an end. More of it is a bit of reflexive...

Read More » The Angry Bear

The Angry Bear