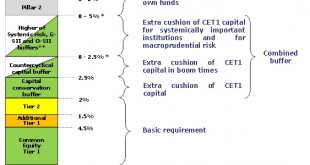

A few weeks ago, in a piece about Deutsche Bank's recent difficulties, I commented about its use of so-called "coco bonds" - contingent convertible bonds. I had over-simplified my description, and was promptly taken to task for doing so by @creditmacro on Twitter. He provided me with a detailed explanation of what coco bonds are and how they work. This piece draws heavily on his input. All of the quotations are from him unless otherwise stated. His full write-up can be found in Related...

Read More »HSBC: the Don Giovanni of banks?

HSBC's results were bad. But they could get a whole lot worse. The list of lawsuits they are facing resembles Don Giovanni's catalogue of conquests, as eloquently explained by his accomplice Leporello. Don Giovanni was, of course, eventually sent to hell as retribution for his crimes. Will HSBC, too, be consigned to fire and brimstone? Somehow I doubt it...My Forbes piece on HSBC's catalogue of lawsuits is here.And if you like Mozart, Leporello's "catalogue aria" is here. The Italian words...

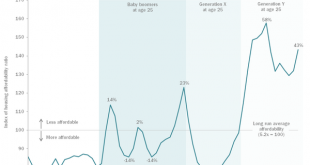

Read More »Don’t blame the boomers

From Joe Sarling's blog comes this a lovely chart showing housing affordability by cohort since 1955: As can be seen, the current generation of young people - Generation Y - faces paying a far higher proportion of their incomes in mortgages or rent than any previous cohort. This does not, of course, take into account the considerable price difference between London and everywhere else: if London were excluded, I suspect their position would not look quite so dire. Nonetheless, this chart is...

Read More »The problem with words

Ah, those pesky words. They do not mean what we think they do. And sometimes we say one thing, but people think we mean another. And so it is that David Glasner, in a beautifully crafted takedown of my previous post, has managed to miss my point entirely.I did, in fact, read carefully all of David's quotation from Ralph Hawtrey, though I did not quote all of it. Hawtrey's point is that what appeared to be destructive competitive devaluation as countries left the gold standard was in fact...

Read More »#QE4People: Frances Coppola

Frances Coppola, influential blogger and tweeter, speaks to EU Reporter's Catherine Feore about why the European Central Bank's Quantitative Easing is not working and how helicopter money and People's Quantitative Easing could help the eurozone recover.

Read More »#QE4People: Frances Coppola

Frances Coppola, influential blogger and tweeter, speaks to EU Reporter's Catherine Feore about why the European Central Bank's Quantitative Easing is not working and how helicopter money and People's Quantitative Easing could help the eurozone recover.

Read More »Competitive devaluation is not a free lunch

It's not often I disagree with David Glasner. Or, for that matter, with Ralph Hawtrey. But I fear I have to take issue with both of them over competitive devaluation. "Bring it on", says David. No, please don't. It's a terrible idea.Hawtrey's pictorial explanation of why competitive devaluation is a good idea seems both charming and plausible: This competitive depreciation is an entirely imaginary danger. The benefit that a country derives from the depreciation of its currency is in the...

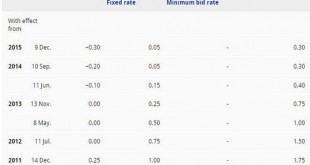

Read More »Negative rates and bank profitability

Banks are complaining. "Negative interest rates hurt our margins," they moan. Here's Commerzbank, for example, in its recent results announcement (my emphasis): Mittelstandsbank attained a solid result in a challenging market environment. The operating profit declined in the 2015 financial year to EUR 1,062 million (2014: EUR 1,224 million), yet remains at a high level. The fourth quarter accounted for EUR 212 million (Q4 2014: EUR 251 million). The full year revenues before loan loss...

Read More »The trade effect of negative interest rates

Yesterday, HSBC prepared the ground for imposing negative rates on business depositors. This is an excerpt from HSBC's letter announcing the necessary change to the Terms & Conditions of HSBC business accounts: Now, this requires some explanation. Firstly, the change applies only to BUSINESS accounts. Retail depositors are unaffected. Secondly, it applies only to currency accounts, not sterling accounts. And thirdly, despite HSBC's mention of "negative rates set by central...

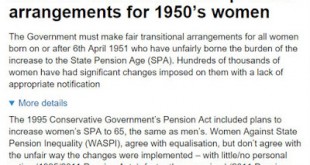

Read More »What they really want

As Henry Tapper puts it, today is WASPI day. Today is the day that "Women Against State Pension Inequality" get the Westminster debate for which they have campaigned.Eh, wait? Wasn't there a debate on this back in early January?Yes, there was. It was a backbench motion proposed by the SNP MP Mhairi Black. It called on the government to re-examine the acceleration of the equalisation of women's and men's pension ages in the 2011 Pensions Act, which added up to 18 months to the state pension...

Read More » Francis Coppola

Francis Coppola