Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate framework is complicated, to say the least. The Bank of Japan has helpfully produced a pretty picture to...

Read More »I am not insane

I have to straighten something out.On 7th January, I made a remark on Twitter which with hindsight was - unwise. Well, ok, it was worse than unwise, it was stupid. I did not think about the consequences. It never occurred to me that issuing that tweet would lead to three weeks of sustained and vicious personal abuse.For obvious reasons, I'm not going to repeat it here. All I will say about it is that it concerned the sex attacks in Cologne and other German cities at New Year, and it was part...

Read More »Much Ado About (Almost) Nothing

President Juncker's European Fund for Strategic Investments (EFSI) has produced an update on its progress to date. The update is a lovely piece of work, with elegant graphics and breakdowns of projects and investments by country and by sector. Really impressive. Kudos to the content management team.But the content - oh dear, the content. The triumph of image over substance. From the EU-wide State of Play document, here is the total amount invested so far - projects and SME financing - and the...

Read More »A countercyclical credit bubble?

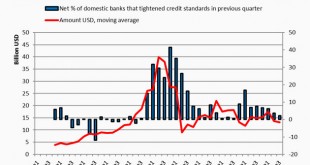

Over at VoxEU, Philippe Bachetta and Ouarda Merrouche have a surprising take on "countercyclical" lending. They show that lending by US and European banks in US dollars to European non-financial corporates massively increased from 2007-2009, and that this helped to soften the effect of the European credit crunch on employment: Over the period 2004 to 2009, we find that foreign credit denominated in dollar to non-financial corporates is countercyclical – it increased sharply (relative to...

Read More »The untimely end of a flamboyant dictator

At Forbes, I have posted the latest episode in the long-running saga of the failure of Hypo Alpe Adria: The story of the failed Austrian bank Hypo Alpe Adria (HAA), and its transformation into the world’s worst “bad bank” – the insolvent HETA – resembles a Hollywood blockbuster. Complete with a cast of thousands, colorful principal characters, an extraordinary range of special (legal) effects and a reach far beyond its national borders, the HETA saga is long, staggeringly expensive,...

Read More »The changing nature of banks, post-crisis edition

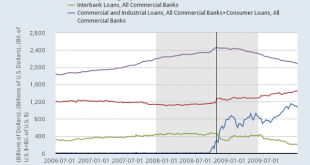

Courtesy of Dr. George Selgin comes this chart from FRED: Dr. Selgin has added a vertical line to indicate when the Fed imposed interest on excess reserves. I don't propose to discuss that here, since I have engaged in an interesting and spirited discussion with Dr. Selgin and others about it on both Forbes and Twitter. I am more interested in what else this chart shows. It is truly fascinating.The first thing to note is the fast rise in bank reserves from the latter part of 2008 onwards...

Read More »Frances Coppola intro to Basic income

Frances Coppola, financial commentator, speaking at 'Basic Income: How do we get there?' Basic Income UK meet-up at St Clements Church Kings Square, London, 3 December 2015.

Read More »Frances Coppola intro to Basic income

Frances Coppola, financial commentator, speaking at 'Basic Income: How do we get there?' Basic Income UK meet-up at St Clements Church Kings Square, London, 3 December 2015.

Read More »Germany’s Sparkassen: banking on capital exports

My latest post at Forbes takes a close look at Germany's much-praised Sparkassen and their odd relationship with other German banks. It's not quite as it seems.... The German Sparkassen (public savings banks) are widely praised for their stability and their service to German savers and small businesses. They survived the 2008 crisis largely unscathed; the few failures were handled within the network, and depositors were compensated from a fully-funded deposit insurance scheme, with no...

Read More »Pensions and stuff

I'm collecting here all the pieces I have written on the UK state pension and its problems. What a shambles. Here are my recent posts, in disaster order. WASPI As I explain in these posts, I would be supportive of WASPI if they were only concerned with addressing the blatant injustice of the 2011 acceleration of the pension age rise for women. But they aren't, and what they are actually after is seriously unfair to other groups. So I can't support them. And I don't like the way they and...

Read More » Francis Coppola

Francis Coppola