Welcome to Three Minute Minute where we talk about all things money without wasting your most valuable asset - TIME. My name is Cullen Roche and I've spent the last 20 years studying money. I've written best selling books, some of the most widely read research in the world and managed billions of dollars in investments. And now I want to spread the knowledge and keep learning. I am excited to help you learn about and navigate the world of money.

Read More »A Cautionary Note About Home Prices

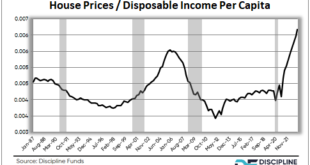

This note is intended to provide some perspective on what appears to be turning into an increasingly speculative fervor in residential real estate. I hope it provides some practical views on the current environment. It was just a year ago that I was here saying residential real estate is not a bubble and that hyperbolic narratives were going too far. And then in my 2022 annual outlook I said that speculating on residential real estate looked increasingly dangerous. Today, I feel bearish...

Read More »Some Pleasant Arithmetic Behind Falling Prices

A few years ago I wrote a post about how I was having trouble constructing portfolios that could meet a conservative 4% rate of return. With bond yields near 0% across so much of the global bond market it was becoming increasingly common to hear that “3% is the new 4%” withdrawal rate. But with the recent bump in interest rates the story has changed dramatically and as is so often the case, lower prices today mean better returns in the future. Let me explain. One thing I love about high...

Read More »Loans Create Deposits & Deposits Fund Loans (Again)

One of the most valuable lessons from the Financial Crisis was that banks don’t lend their reserves to non-banks in the way that the textbook money multiplier implied. This had important implications for inflation since it meant that there was little to no risk of high inflation from the Fed’s “QE money printing” because it was operationally impossible for those reserves to leave the banking system and cause more money to chase fewer goods. Thinking of QE as an “asset swap” was a useful...

Read More »The Fed is About to Make a Huge Policy Error

In May of 2020 I was on Anthony Pompliano’s podcast describing the likelihood of high inflation in the coming years and the Fed chasing their tail as this became evident in 2021/2022: “I don’t see how there can’t be some inflation that comes out of this…I’m not transitioning into a hyperinflation sort of mentality but I don’t see how there’s any chance that coming out of like, say 2021 or 2022, that if the economy is really rebounding that we don’t have three, four, five percent [core]...

Read More »Three Things I Think I Think – Where Did This Idea Come From?

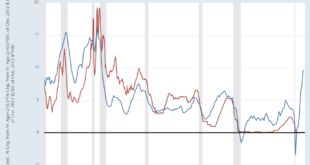

Here are some things I think I am thinking about. 1) 60/40 Stocks/Bonds – Where did this idea come from? Here’s Corey Hoffstein on Twitter asking where did the 60/40 portfolio come from? It’s an interesting question – after all, the 60/40 has become the gold standard of portfolios so you’d think that there’s very strong empirical support for this specific allocation. Except there isn’t really. In fact, when we look at the historical data the exact opposite portfolio (a 40/60) has been the...

Read More »Is The Fed on the Verge of a Policy Mistake?

I’ve never been a big fan of discretionary Fed policy. In my opinion the overnight rate is something that should be automated rather than being controlled by the subjective views of a few people at the Fed. This is a major point of contention in economic and political circles as many people argue that discretionary Fed policy leads to an unnecessarily subjective management of QE and interest rates. I broadly agree with this view. The basic criticism is that a subjective rate policy leaves...

Read More »Cullen Roche: Total Portfolio Fees

Taken from "ReSolve Riffs with Cullen Roche on Decoding MMT: The Good, the Bad and the Ugly" https://www.youtube.com/watch?v=zSmK1TLLvvA ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-cullen-roche-on-decoding-mmt-the-good-the-bad-and-the-ugly/ ============================================================= For our latest research insights and exclusive content visit our...

Read More »Cullen Roche: Alternative Sleeves, Why Bother?

Taken from "ReSolve Riffs with Cullen Roche on Decoding MMT: The Good, the Bad and the Ugly" https://www.youtube.com/watch?v=zSmK1TLLvvA ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-cullen-roche-on-decoding-mmt-the-good-the-bad-and-the-ugly/ ============================================================= For our latest research insights and exclusive content visit our...

Read More »Cullen Roche: Demographics and Housing

Taken from "ReSolve Riffs with Cullen Roche on Decoding MMT: The Good, the Bad and the Ugly" https://www.youtube.com/watch?v=zSmK1TLLvvA ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-cullen-roche-on-decoding-mmt-the-good-the-bad-and-the-ugly/ ============================================================= For our latest research insights and exclusive content visit our...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism