Taken from "ReSolve Riffs with Cullen Roche on Decoding MMT: The Good, the Bad and the Ugly" https://www.youtube.com/watch?v=zSmK1TLLvvA ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-cullen-roche-on-decoding-mmt-the-good-the-bad-and-the-ugly/ ============================================================= For our latest research insights and exclusive content visit our...

Read More »Cullen Roche: QE and the Banking Stuff

Taken from "ReSolve Riffs with Cullen Roche on Decoding MMT: The Good, the Bad and the Ugly" https://www.youtube.com/watch?v=zSmK1TLLvvA ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-cullen-roche-on-decoding-mmt-the-good-the-bad-and-the-ugly/ ============================================================= For our latest research insights and exclusive content visit our...

Read More »Cullen Roche: Aha Moments

Taken from "ReSolve Riffs with Cullen Roche on Decoding MMT: The Good, the Bad and the Ugly" https://www.youtube.com/watch?v=zSmK1TLLvvA ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-cullen-roche-on-decoding-mmt-the-good-the-bad-and-the-ugly/ ============================================================= For our latest research insights and exclusive content visit our...

Read More »Three Things I Think I Think – Rising Recession Risk

Here are some things I think I am thinking about: 1) Are we on the verge of a recession? My theory about the COVID recession is that it wasn’t really a recession in the traditional boom/bust sense. It was more like a natural disaster or an exogenous shock to the economy because of the way the government shutdown so much of the economy. It was a self imposed recession as opposed to some naturally developing boom/bust. Then the government responded with unprecedented stimulus, the economy...

Read More »The Fed is in an Impossible Bind

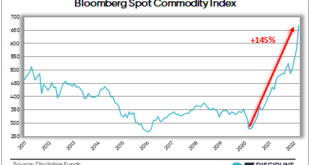

The inflation story looked pretty clear to me before Russia invaded Ukraine. COVID had caused supply constraints and unemployment, we responded with $7T of government spending and so we ended up with the perfect recipe for high-ish inflation. By the beginning of this year there were signs that auto prices were rolling over, commodity prices were slowing their rate of change and the global economy was fully opening back up and supply chains were loosening. And then boom. Russia invaded...

Read More »Three Investing Lessons from the Russian Stock Market Collapse

The Russian stock market collapse has been jaw dropping with a near 80% loss in just a matter of weeks. Here are some important lessons we can all learn from this epic catastrophe. Lesson #1 – Beware of home bias. Below is a great chart from Jeffrey Kleintop at Schwab showing how much investors tend to overweight their home country. Virtually everyone does it. And it makes some sense especially if you can access a market like the USA where a good amount of the domestic corporate revenues...

Read More »Three Things I Think I Think – War, Nails & Broken Markets

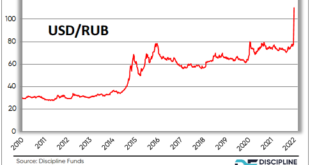

I’m thinking mostly about the war in Ukraine, but here’s some other stuff to distract you (although this will be mostly about the war in Ukraine, sorry). 1) The limits of government solvency. So much to say about the Russian invasion of Ukraine. Honestly, it has me pretty depressed. Maybe it’s just being a new dad and worrying about the world my daughter’s will grow up in. I’m not sure. I’m usually a very optimistic person, but I think Putin has lost his marbles and I don’t see how this...

Read More »Three Things I Think I Think – War

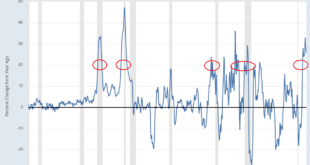

I’ll break this down into three things, but it’s really just one thing – war. 1) Is it time to panic? Here’s some good perspective of geopolitical conflicts and market returns over the last 75 years from Tom Morgan and BCA research (Tom is a great follow on Twitter by the way in case you don’t already). Long story short, this always causes short-term turmoil with the market generally falling at least 10% and then rebounding over the course of the coming year. Of course, this is an...

Read More »Is the Bond Bear Market Over?

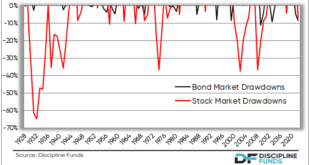

The Total Bond Market is down 5.5% from its 2021 peak. The 10 year T-Note is down 10.7% from its 2020 high. But with the market pricing in 7 rate hikes and inflation showing signs of topping it’s worth asking if the worst is behind us? I believe we’re getting close to the end of this bond bear market. I’ll explain why. 1) Bond bear markets are a totally different beast from stock bear markets. It’s become increasingly common to hear that we should abandon bonds in favor of stocks or other...

Read More »A Little Love for American Economic Data

Since it’s Valentine’s Day I might as well spend some time expressing thanks for my one true love – good data. I spend an exorbitant amount time compiling data. And I often feel very grateful to live in a country where data is transparent and abundant. And oh boy is it abundant. While there are numerous private data sources some of the very best data sources come from the US government. Consider just a few of the resources here that compile regularly updated data: I use most of these...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism