I like to emphasize that QE is a simple asset swap that happens after the primary asset issuance. That is, the government issues some amount of bonds when they run a deficit. And then the Central Bank implements QE by expanding their balance sheet by creating reserves and then swapping some quantity of those reserves for bonds. The private sector ends up holding more deposits and the Central Bank takes the bonds out of circulation. It is the logical equivalent of changing a savings account...

Read More »Do We Really Understand Inflation?

I recorded a great podcast with Peter McCormack when I was in NYC last month. This one was a little different for me and I think you’ll enjoy it. Peter runs the What Bitcoin Did Podcast, one of the few Bitcoin podcasts I listen to regularly. Peter is a Bitcoin maximalist, but embraces his maximalism without a lot of the brash arrogance that you sometimes find in other Bitcoiners. He’s a great guy and very thoughtful. I loved talking to him. We covered a whole range of topics. I think...

Read More »Do We Really Understand Inflation? with Cullen Roche

SHOW NOTES: https://www.whatbitcoindid.com/podcast/do-we-really-understand-inflation In this interview, I talk to investment strategist and founder of the educational website Pragmatic Capitalism, Cullen Roche. We discuss the drivers for inflation, the role of government, investment strategies during uncertain times, and the place for Bitcoin in asset portfolios. THIS EPISODE’S SPONSORS: Gemini - https://www.gemini.com/ BlockFi - https://blockfi.com/peter Sportsbet.io -...

Read More »Timeless Investing Lessons: Rob Arnott, Michael Mauboussin, Ben Inker, Cullen Roche, Tobias Carlisle

10 Lessons From Our 5 Most Popular Podcasts of 2021 - Rob Arnott, Michael Mauboussin, Ben Inker, Cullen Roche, Tobias Carlisle Our goal when we started the Excess Returns podcast was to hopefully use the platform to help educate investors, and to learn ourselves in the process. Initially, we didn’t have outside guests on the podcast, but it quickly became evident that bringing in voices other than our own would significantly help us in achieving our goal. Starting with our first...

Read More »10 Questions for 2022

I don’t love to forecast the short-term moves of what are inherently long-term financial markets, but I also know we live in the short-term and that perspective provides us with knowledge which helps make us more robust to behavioral mistakes. I hope these 10 questions/answers provide you with some useful perspective on the year to come and that your 2022 is a fantastic one. About Post Author ...

Read More »The Best of Pragmatic Capitalism 2021

Whew. What a year. Pragcap passed 50 million total page views this year. Crazy. I’ve stopped writing as much in recent years mainly because of some personal stuff and getting bogged down building a damn house, but I am hoping to get back to it more this year so stay tuned. In summary, here’s some of my favorite pieces from this year. Best wishes in 2022. I hope it’s an amazing year for you. Hope is a great strategy. This was a really personal piece and not finance related, but one of the...

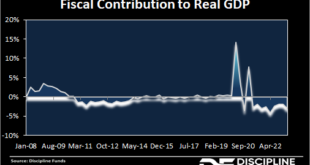

Read More »Three Things I Think I Think – Bye Bye Bye BBB

Here are some things I think I am thinking about: 1) Bye Bye Bye BBB. It looks like Build Back Better is getting nuked. Or, at a minimum, reduced. I haven’t talked about this bill that much because I didn’t think it was a hugely important short-term economic driver. To put things in perspective, it was estimated to add $150-200B to the deficit in the next few years. The spending was drawn out over 10 years so even though the trillion $+ bill sounds big it was relatively small when broken...

Read More »378 – Cullen Roche, Discipline Funds – Inflation, The Federal Reserve & Disciplined Investing

To see links or read the transcript of the episode, visit us at: https://mebfaber.com/2021/12/20/e378-cullen-roche/ In episode 378, we welcome our guest, Cullen Roche, founder and Chief Investment Officer of Discipline Funds, a low fee financial advisory firm with a focus on helping people be more disciplined with their finances. In today’s episode, Cullen begins by sharing his framework for thinking about inflation and the impact of both monetary and fiscal policy. He explains...

Read More »Hope is a Great Strategy

“Hope is an optimistic state of mind that is based on an expectation of positive outcomes with respect to events and circumstances in one’s life or the world at large.” Five years ago I pulled over on the I-5 freeway sobbing. I couldn’t drive. I had been on my way home from a fertility clinic where I’d just learned that it was going to be hard for us to have children. But I still had hope. And so I called the doctor and asked for a more specific answer: Me: “I’m a numbers guy. Shoot me...

Read More »The Exchange: Cullen Roche

On this episode of #TheExchange, hear from Cullen Roche, Founder and CIO at Discipline Funds, all about the Discipline Fund ETF (NYSE Arca: DSCF).

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism