Here are some things I think I am thinking about: 1) NYC is ALIVE! I landed in NYC on Monday morning at 630 AM with a scheduled media spot on the floor of the NYSE at 10:30. I slept in an airport lounge for two hours and then hopped across the river. I’ve been to NYC enough times to know that it always takes longer to get places than you think so I left the airport at 9AM to give myself 90 minutes to get to the NYSE. I figured that was at least a 30 minute buffer. But the city is alive....

Read More »Three Things I Think I Think – “Transitory” is…Transitory

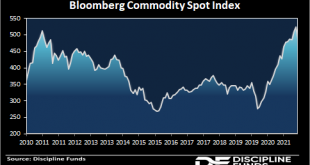

Here are some things I think I am thinking about: 1) Good bye Transitory, we barely knew you. Jerome Powell says the Fed should “retire” the term “transitory”. I like the sound of that. As I said back in July: “My view is that they should stop using this term entirely and try to more accurately communicate inflation and its likely future paths.” This term was always confusing because people perceive inflation as price changes. When gas goes from $3 to $4 and then to $4.25 the Fed would...

Read More »The Constitution DAOwner and the Winner’s Curse

I had never watched a Sotheby’s auction live so I really didn’t know what I was getting myself into, but boy was this exciting. So, long story short – a bunch of crypto enthusiasts created a thing called Constitution DAO. A DAO is a Decentralized Autonomous Organization. Basically, it is a decentralized organization that operates on the blockchain to achieve some specified purpose. In this case the purpose was to buy one of the only privately owned copies of the Constitution which was...

Read More »Three Things I Think I Think – Shadowy Stuff

Here are some things I think I am thinking about. 1) Shadow Stats Debunked! It’s been a huge couple of weeks here at Pragmatic Capitalism when it comes to official myth busting. First we had the money multiplier officially being denounced by the Fed and now we have Shadow Stats officially being debunked. At this rate I won’t have anything to write about in the coming years. Maybe that’s a good thing? Anyhow…. Measuring inflation is hard. Everyone’s experience of inflation is different and...

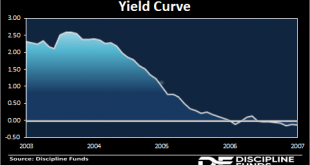

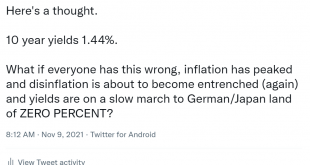

Read More »The Return of the Bond Market Conundrum

John Authers has a fantastic piece in Blomberg discussing the return of the Greenspan Conundrum. This is something I’ve mentioned many times in the last few months. I won’t try to rehash all of his points because he does a far better job than I can do. But for those who are too young to remember, the Greenspan Conundrum occurred when Alan Greenspan raised interest rates during the housing bubble. The Fed hiked overnight rates from 1% all the way to 5% and the 30 years Treasury Yield moved...

Read More »Three Things I Think I Think – Fiscal Policy Did It

Here are some things I think I am thinking about. 1) Government spending staved off a much worse scenario. The inflation surge is sparking some heated discussions on the economy and the net benefit of the COVID stimulus. On the one hand, many things look great. On the other hand, inflation is hurting a lot of people more than this headline data makes it seem. My basic view is that the stimulus was worth it on the whole. I was very vocal about the risk of high inflation through all of 2020...

Read More »Everything’s Amazing and Nobody’s Happy

As I get older I am trying to do a better job of seeing both sides of all arguments so I am not tone deaf to the very real problems that a lot of people have, that all of us might not have. And here’s one that I hope you’ll help me out with because I don’t know if I have the right answers for it. Here are some interesting stats about the current state of affairs: GDP – all-time high Stock prices – all-time high Real estate prices – all-time high Household net worth – all-time high...

Read More »What if it’s All Going to Zero?

People often ask me: “What’s the point of owning bonds with interest rates so low?” I’ve heard this question for most of my career and while the risk profile of owning bonds has changed, they still serve the same purpose in a portfolio that they always have: To provide you with stability when you most need it (usually when the stock market is declining).¹ To provide you with some income that makes them superior safe haven assets when compared to cash. As I’ve explained before, this is as...

Read More »ETF Investing | All you need to know w/ Cullen Roche (TIP394)

By popular demand, Stig Brodersen has invited back investment expert Cullen Roche. They discuss how to execute on the best possible ETF strategy. IN THIS EPISODE, YOU'LL LEARN: 0:00:00 -Intro 0:00:58 - Which ETF strategy is right for you? 0:06:48 - Why there is no such thing as passive investing? 0:12:57 - How does an ETF technically work, and why is it a tax-efficient investment instrument. 0:19:30 - What is the difference between the gross and net expense ratio? 0:24:13 - Should you pay...

Read More »394 TIP. How to Invest in ETFS w/ Cullen Roche

By popular demand, Stig Brodersen has invited back investment expert Cullen Roche. They discuss how to execute on the best possible ETF strategy. IN THIS EPISODE, YOU'LL LEARN: 0:00:00 -Intro 0:00:58 - Which ETF strategy is right for you? 0:06:48 - Why there is no such thing as passive investing? 0:12:57 - How does an ETF technically work, and why is it a tax-efficient investment instrument. 0:19:30 - What is the difference between the gross and net expense ratio? 0:24:13 - Should you pay...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism