Inflation is all the rage these days and it’s pretty much all I’ve been talking about lately. Here are some good resources I’ve produced in the last few weeks on the current inflation environment and how you can put it into the right perspective. Validea Podcast on inflation. We discuss: the various ways to measure it and how they are different the history of inflation in the US why quantitative easing didn’t cause inflation, but fiscal stimulus did the major forces that have kept...

Read More »The US Stock Market is Not as Exceptional as We’ve Been Told

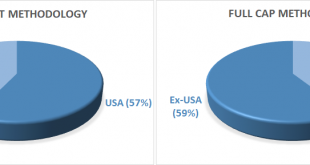

One of the interesting things about going through the process of building an asset management company is that you can get bogged down in the regulatory weeds about the meaning of specific words. I’ve discussed the general nature in which the finance and economic industries (mis)use terms like “money” or “passive investing” in ways that render them virtually meaningless. But the biggie I’ve come across more recently is the concept of “global stock market capitalization” – the total actual...

Read More »Everything You Need to Know About Inflation with Cullen Roche

Inflation is probably the most talked about topic in investing today. Some think it has become a major problem. Others (including the Fed) think it is transitory. While still others think we are headed for a repeat of the 1970s or even hyperinflation. But many of the opinions on both side are not informed by the facts. So we wanted to do an episode where we started with the basics to help us understand what is going on now, and what might happen in the future. To do that, we couldn't think...

Read More »Three Things I Think I Think – Some Weekend Thinking

Here are some things I think I am thinking about: 1) The One Income Family is Never Coming Back. Here’s Blake Masters running on a platform for Arizona Senate that includes bringing back the one income family. You’ve probably heard or thought about this. The theory goes like this – American living standards are worse because it now takes two working parents to support a family as opposed to one income like the “good old days”. I think this narrative is somewhat backwards. Not only does...

Read More »Is Hyperinflation Coming?

Twitter lit up over the weekend when Jack Dorsey said that hyperinflation is coming. Dorsey is a very vocal advocate of Bitcoin and of course, also the CEO of two public companies, Square and Twitter. This is a pretty interesting prediction for a CEO of a large public company for several reasons: If he really believes what he said then he should, as a fiduciary to his shareholders, be advocating for far less USD exposure within his companies. Michael Saylor has developed the playbook for...

Read More »Cullen Roche

The author, money manager, and one of the most astute financial minds we know has some big news to share (Episode 187 of the Teach and Retire Rich podcast https://teachandretirerich.libsyn.com/).

Read More »Get The Fed (and Government) Out of the Stock Market

The Federal Reserve has announced a sweeping set of strict rules to prohibit its employees from owning individual stocks, holding investments in individual bonds, holding investments in agency securities, or entering into derivatives. This is fantastic news following last week’s reports of rampant trading by Federal Reserve officials in recent years that create, at a minimum, the appearance of a conflict of interest. But these law changes do not go nearly far enough as the Fed remains far...

Read More »Did Bitcoin Kill Gold’s Monetary Utility?

I’ve always loved Harry Browne’s Permanent Portfolio. The concept is so simple and clean – own equivalent ratios of assets that protect you in an “all weather” fashion: 25% stocks for growth/expansions 25% bonds for income/deflations 25% cash/t-bill for liquidity/recessions 25% gold for inflation hedging This portfolio is a close approximation of a Global Market Portfolio. It’s simple, diverse and covers all the bases that we might expect to encounter across an economic cycle. It’s also...

Read More »MacroVoices #293 Cullen Roche: Debt Ceiling, Interest Rates & Stagflation

MacroVoices Erik Townsend and Patrick Ceresna welcome Cullen Roche to the show to discuss the debt ceiling debate, why a platinum coin supposedly solves perpetual motion and buys a free lunch for deficit spending, where inflation is headed, and much more. 00:00 Intro 00:38 Market Wrap 11:30 Feature Interview with Cullen Roche 57:15 Postgame - Breakout! Download Big Picture Trading Chartbook ??https://bit.ly/2YVBOY7 ✅Sign up for a FREE 14-day trial at Big Picture Trading:...

Read More »R.I.P. – The Money Multiplier

Well, it took me 10 years to kill it, but I finally did it. I killed the money multiplier. I kid of course. I didn’t do it on my own.¹ It was a mass murder thanks to many of us. But regular readers will know that I have been on a sort of personal crusade to destroy this narrative for over a decade now. I have to admit. It put up a good fight and it was harder to kill than I would have expected. But it’s officially dead according to the Federal Reserve: It’s a weird feeling being so happy...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism