Here are some things I think I am thinking about: 1) Stocks are more like bonds than we want to admit. Eddy Elfenbein had a great post titled “What if the stock market were a bond?” I’ve talked about this concept in the past. This is by no means a new concept. Warren Buffett has described stocks as perpetual bonds. And William Bernstein has described stocks as having duration-like properties that make them similar to super long duration bonds. Now, you have to be careful with this topic...

Read More »Three Things I Think I Think – Not Nice

Here are some things I think I am thinking about: 1) Class warfare – Nice or Not so Nice? Here’s a California Assemblywoman telling Elon Musk to “f$ck” off earlier this year: And here’s Elon Musk f$cking off right over to Texas by moving both the Tesla HQ to Texas as well as his new state of residency. I really don’t understand this class warfare thing. I know that inequality is a problem and I can understand the sentiment that the wealthy should pay higher taxes. But I really don’t...

Read More »Three Things I Think I Think – Myths that Never Die

Here are some things I think I am thinking about. 1) The government is running out of money – NOT. It’s hard to kill old myths. Really hard. I’ve spent countless hours trying to debunk the idea that the US government is “running out of money”. But here we are having another debate about the “debt ceiling” and this fake idea that a government with a literal printing press is somehow going to run out of money because we imposed a fake credit limit on it. I’ve explained the absurdity of the...

Read More »The Zoom Climb Glide Path & Why the Age in Bonds Rule is Wrong

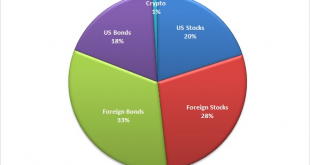

In aeronautics a “zoom climb” is when an aircraft accelerates at a very high rate of speed and then ascends sharply at a very steep rate. It’s often performed with the aircraft moving at a high rate of speed at a low altitude and then shooting higher in a nearly 90 degree angle. I know nothing about aeronautics, but I know some stuff about money and I am going to explain how this concept can be applied to retirement planning and potential future glide paths. I also think this is a useful...

Read More »Three Things I Think I Think – Dangerous & Terrible Stuff

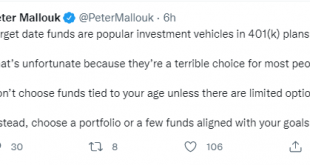

Here are some things I think I am thinking about: 1) Are target date funds “terrible”? Here’s Peter Mallouk, CEO of Creative Planning, on Twitter saying that target date funds are “terrible”: I asked him to elaborate: Peter’s a great follow if you use Twitter. Just a super practical thinker and all around good guy. And I think he’s touching on something important here. Personally, I am a huge fan of any investment strategy that I would categorize as a Discipline Based Investing approach....

Read More »It’s Time to Break the Debt Ceiling

Another year, another debt ceiling debate. I think it’s been over 10 years since I first talked about how ridiculous this all is. For those of you who have been paying attention all that time – you know the story. The way this works is simple: Congress establishes a “debt ceiling”, a fake limit on how much national debt we can issue. Then Congress approves legislation that will require new debt in the future. That new legislation causes a breach of the debt ceiling. Congress pretends...

Read More »Three Things I Think I Think – Not So Grande Stuff

Here are some things I think I am thinking about: 1) So, not so grande, eh? China Evergrande, the Chinese real estate developer has everyone worried these days about the second coming of Lehman Bros. The company has shrunk by about 90% so they’re not so grande anymore. Get it? Did you catch that joke? Geez, I am hilarious. Maybe they should call themselves Nevergrande? Get it? Did you catch that joke? I’m here all day folks. This sort of thing has happened a few times in the last 10 years...

Read More »Introducing the Discipline Fund ETF

I am thrilled to announce the first day of trading of the Discipline Fund ETF on the New York Stock Exchange under the ticker DSCF. Discipline Funds is a new company that I’ve formed in 2021 to serve as the fund management arm of my investment advisory firm, Orcam Financial Group, LLC. We’ve partnered with the NYSE and Wes Gray at Alpha Architect to make this happen. These are incredible partners. You have no idea. Well, maybe you do. Anyone who knows the NYSE knows, well, it’s the NYSE....

Read More »Yes, Dow 36,000 Was Very Wrong

Ken Rogoff took the WSJ yesterday to explain why the infamous Dow 36,000 prediction wasn’t wrong. He writes: Their simple policy advice: Buy a diversified portfolio of stocks, and don’t put too much money in bonds. Over the long run, stocks offer a higher return without significantly greater risk. He goes on to explain that this advice was somehow correct. The problem is, if you chose not to hold bonds in 1998 you generated far worse nominal AND risk adjusted returns than a simple 60/40...

Read More »Three Things I Think I Think – It’s Crypto All The Way Down….

It’s all anyone can talk about these days so I guess it’s all I can think about….crypto, crypto, crypto.¹ 1) El Salvador and Bitcoin. El Salvador officially adopted Bitcoin as a form of legal tender yesterday. We’ve discussed this before, and it is very, very, very strange, but maybe not so strange in the specific case of El Salvador (ES). So, long story short – ES is a small country that has an unusually high amount of dollar imports mainly because they’re an export based economy that has...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism