Sometimes it feels like our world is becoming more closed off despite the fact that we’re more interconnected than we’ve ever been. This interconnectedness is new and scary in ways. I get it, but it’s also exciting and something I think we should try to embrace. Of all the investments I’ve ever made in my life travel is certainly among the very top. I was fortunate to be born to parents who loved to travel. My mom and dad would lug all 8 of us all over the USA and the world. It not only...

Read More »Thanks, Jack….

Jack Bogle is gone, but his impact will last forever. That’s certainly true for me. No single person had a bigger impact on my firm and career direction than Bogle did. He is, essentially, what I’ve modeled so much of my life and work around. It started with “Enough”, Bogle’s second most brilliant piece of work (behind the Little Book of Common Sense Investing). I remember reading it in the depths of the financial crisis and it shaped the way I see so much of life. The key message of the...

Read More »My View On…AOC

Alexandria Ocasio-Cortez (AOC)…wow, like a whirlwind, she went from virtual nobody to Congressional sensation. These days it’s almost impossible to avoid hearing about her. Rightfully so, her story is a pretty amazing one. I won’t rehash that story, but she does have some bold economic views so I am going to force my unwanted opinions on you regarding that topic. AOC is a Democratic Socialist like Bernie Sanders. I’ll be honest – I don’t tend to like extremists on either end. I spend a lot...

Read More »You Can’t Debunk MMT

Back in 2010 I came across Modern Monetary Theory (MMT) for the first time and found it somewhat appealing. This is the theory that Alexandria Ocasio-Cortez promoted along the way to her meteoric rise to Congress. MMT is a theory of economics that says some pretty controversial stuff – the government has a real budget constraint unlike a household, monetary policy is very ineffective and the government should run large scale Job Guarantee programs to ensure full employment. I like a lot of...

Read More »Is This The Worst Thing The WSJ Has Ever Published?

Well, I thought that 2018 had to be peak stupidity for humanity, but we are not off to a good start in 2019. I opened the Wall Street Journal this morning to find this article which has a falsehood in every single paragraph. 10 for 10. Let’s review this impressive mess. First, the title, “The Fed’s Obama-Era Hangover” is just catchy politics. The Fed is an independent entity and President Obama had nothing to do with the policies enacted by the Fed, but the entire article disparages...

Read More »The Best Lessons of 2018 – Patience & Discipline

All the best stuff in life takes time – love, friendship, wealth, etc. We want all of these things to happen immediately, but the reality is that they all take a lot of work. They take discipline and patience. There really are no shortcuts. The financial markets reminded us of this in 2018. The global stock market finished down about 10% and the US stock market was down about 4.5%. Amazingly, after all the constant fear mongering about bonds, the Barclays Bond Aggregate finished…positive...

Read More »Trump Didn’t Cause the Stock Market Downturn

Warning – this is going to piss half of you off and make the other half think I am a Trumper. Sorry to disappoint all of you in advance. There’s been a lot of angst and finger pointing in recent weeks about the downturn in the stock market. The easiest target, and the most vocal, has been Donald Trump. I think I’ve been pretty balanced with Trump over time. I said he wasn’t responsible for the 2017 stock bull market and while I’ve poked some fun at him here and on Twitter and derided him...

Read More »It’s Not Time to Panic (Yet)

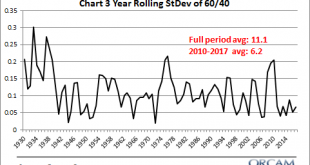

So, the market’s finally gotten a little interesting. It’s been a while. I feel like we’ve been sleepwalking through years of stable and steady market returns. In fact, the last few years have been unusually stable. The 3 year rolling standard deviation of a 60/40 stock/bond portfolio has been just 6.2 since 2010. The average since 1930 is 11.1. So, we’ve been spoiled by high and stable returns in the post-crisis period and now it looks like the party is ending. But does that mean we...

Read More »Let’s Talk About QE and Assflation

I was on Twitter talking about how Donald Trump knows nothing about monetary policy and how Jerome Powell and the Fed should ignore him. It’s true. Trump really knows nothing about this stuff. For instance, take a look at some of his old Tweets on QE. They’re basically a rambling mess of hyperinflation predictions. The Fed’s reckless policies of low interest and flooding the market with dollars needs to be stopped or we will face record inflation. — Donald J. Trump (@realDonaldTrump)...

Read More »The Counterproductive Nature of Annual Forecasts

The annual parade of Wall Street forecasts are starting to rollout. I will be honest – I love these things like a fat kid loves cake. It’s fun to try to predict and plan for the new year and there’s no better way to do that than to read what a whole bunch of smart people are predicting. The problem is, annual forecasts are worthless and I would argue even counterproductive. Let me explain why. I’ve talked a lot about how I like to think about all financial assets as bonds. I know, I know,...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism