I’ve noticed a trend in some economic circles that seems to stem from the Positive Money and MMT people – this idea that government “debt” is “equity”. While the taxonomy in mainstream macroeconomics can sometimes be messy I don’t think this is a case where we need to be trying to reinvent well established terms. Let me explain. First off, I understand the desire to create a more coherent taxonomy for terms that seem to have no meaning (for instance, the term “money” in mainstream macro),...

Read More »The Monetary Duration Dilemma

I’ve been careful in my research on money not to call money a “store of value”. There’s a good reason for this which I will try to explain in this piece. In traditional definitions of money three criteria are generally applied: Unit of account Medium of exchange Store of value The first two are uncontroversial. Money needs to be denominated in a unit of account (the USD, Yen, Euro, etc) and it needs to be a medium of exchange. As a store of value, however, the best money cannot serve this...

Read More »Reconciling Krugman vs Kelton

Warning – This is going to be another nerdy one. I apologize in advance. Paul Krugman and Stephanie Kelton are two very good economists. They’re also people I’ve had fights with over the years. Not physical fights. Make no mistake – I am a big wimp, but I could kick both of their asses at the same time with one arm tied behind my back. But as someone who leans somewhat towards Post-Keynesian economics and is critical of both MMT (Kelton’s camp) and New Keynesian economics (Krugman’s...

Read More »MMT’s True Colors Appear

Modern Monetary Theory, aka MMT, has hit the mainstream and some Liberal politicians like AOC are giving it full-throated endorsements. I need to stop playing Mr. Politically Correct with this idea – it is dangerous and we need to start saying that outright. Now, I’ve been generally fair over the years. I was very critical of Conservative Austrian style economics for years when they were pushing the narratives about how QE would bankrupt us and cause hyperinflation. If anything, I’ve...

Read More »Three Things I Think I Think – Buffett Letter Edition

The 2018 Berkshire Hathaway letter to shareholders is 14 pages of the usual goodness, but I wanted to skip right to the end and all the best stuff. Over pages 13 and 14 Buffett goes through a brief history of the United States and its successes. In doing so he touches on many themes that are essential elements of this website. Namely: Okay, that’s more than three things. Actually, Buffett refers to it all as one thing – “The American Tailwind”. Whatever it is, it’s lots of good stuff so...

Read More »How Bond Vigilantes Really Think

Discussions on interest rates tend to fall into two camps – the state based view and the market based view. The state based view says that the government can always control the cost of its interest while the market based view argues that the market (typically “bond vigilantes”) can control the rate of interest. I find both of these views confused or at least misleading. One of the nice things about being an actual bond portfolio manager is that I see how prices are set every day. I’ve...

Read More »My View On: The Green New Deal

The idea of a “Green New Deal” is all the rage on the left these days. This is a huge, bold plan to transform the US economy. Here are some highlights from the proposal: Net zero greenhouse gas emissions within 10 years by replacing “all existing buildings in the USA” to achieve maximal energy efficiency. “High quality health care”. “High quality education, including higher education”. “Affordable housing”. “Guaranteeing a job with a family sustaining wage” and full benefits. Save the...

Read More »Banning Stock Buybacks is Stupid

(I did a quick hit on Bloomberg TV yesterday discussing buybacks, but I wanted to dive in in a bit more detail. You can see my brief comments here at the 5:30 second mark.) In today’s edition of People Are Saying Stupid Things About Stock Buybacks I want to talk about the Chuck Schumer and Bernie Sanders proposal to ban stock buybacks. Here it is in case you want to become a little bit dumber. Snark aside, I found the op-ed kinda lazy. Their proposal can be boiled down to: “Share buybacks...

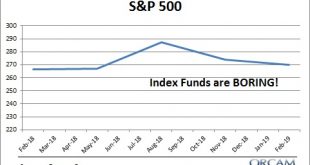

Read More »How The Patient Investor Sees the World More Clearly

One of my favorite things to think about in investing is the theoretical investor who slept through 1987. We all know about “Black Monday”, the crash of 1987, when stocks fell 23% in one day. It was terrifying. But the craziest thing about 1987 is that the S&P 500 had a total return of 5.81% that year. The stock market was positive in a year that is known for being a terrifying crash! So, if you had checked your portfolio on January 1, 1987 and then slept through the entire year and...

Read More »MMT – The Good, the Bad and the Ugly

Modern Monetary Theory (MMT) is in the news a lot lately. And that has resulted in a number of “critiques”. Most of these critiques are, to be blunt, trash. You see, the thing is, MMT is really, really confusing and most people don’t get it right at first. So we tend to see lots of “critiques” of MMT that aren’t based on a sound understanding of it. I know this because I went through a phase almost 10 years ago where I first encountered MMT, thought it was largely right and then realized...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism