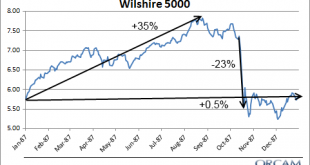

Share the post "This Sucker’s Going Down"30 years ago the market crashed 23% in one day. It’s everyone’s worst nightmare – seeing their savings get cut in a quarter overnight. This is obviously traumatic so it’s rational to worry about such an event. There are important lessons in big traumatic events like this so let’s dive deeper.I have a simple recurring theme about life and markets on this website – life is mostly just a boring trend of similarly monotonous stuff that gets jarred loose...

Read More »Financial Wisdom Part Three – Funny Money

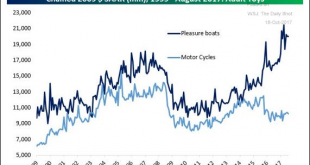

Share the post "Financial Wisdom Part Three – Funny Money"Here is part three of the Abnormal Returns blogger wisdom:Question: What is one thing you do with your money (spending and/or investing) that you would never recommend to a client, family or friend?My answer:About 10 years ago I bought a boat. Or, as boat owners say, BOAT – Bring Over Another Thousand. This was, by far, the worst financial decision I ever made in my life. Although it was enjoyable the cost of upkeep and maintenance...

Read More »Financial Wisdom Part Deux – Factor Investing

Share the post "Financial Wisdom Part Deux – Factor Investing"Here is question two from the Abnormal Returns blogger wisdom series:Question: Assume you have discovered an equity return factor that is both previously unknown and uncorrelated with other factors. What would you do to monetize that insight? (Answers in no particular order.)My answer:Well, I’ve been pretty negative about factor investing so it would be pretty damn hypocritical of me to start a factor fund. I am deeply skeptical...

Read More »Cryptocurrencies are Non-Financial Collective Equity

Share the post "Cryptocurrencies are Non-Financial Collective Equity"One of the troubles with understanding the cryptocurrency boom is that the existing definitions aren’t consistent. We call all of these things “currencies”, but that implies that they are all money which is incorrect. For instance, Filecoin is basically a decentralized version of Dropbox. It isn’t a currency at all. It has an exchange value, but it isn’t a “currency” in the traditional sense of the word. This space is so...

Read More »Moneyness, Utility & Network Effects

Share the post "Moneyness, Utility & Network Effects"Eric Lonergan has been cranking out some good stuff on money and language in the last few weeks which got me thinking again about “moneyness” and the network effect of a money system. I wrote a piece on Moneyness back in 2012 that I think describes a realistic operational scale of the utility of money. In short, we use the most credible form of money that has the most utility accessing the payment system.Now, this concept is rather...

Read More »Would I Make a Buffett Bet 2.0?

Share the post "Would I Make a Buffett Bet 2.0?"Here’s the first question in the Abnormal Returns blogger wisdom series:Question: Let’s say Warren Buffett re-ups his famous decade-long bet. (He’s not.) He takes the S&P 500. What would you take (and why)?My answer:This is a more interesting bet now. In the 5 years prior to the 2008 bet the US markets had only compounded at about 9% vs the 13% rate of the last five years. But I’d throw in a caveat. Comparing the nominal returns of the...

Read More »Donald Trump is Wrong About the National Debt (Again)

Share the post "Donald Trump is Wrong About the National Debt (Again)"Here’s a very inaccurate comment by Donald Trump from yesterday:“Now, if you look at the stock market, that’s one element, but then we have many other elements. The country — we took it over, it owed $20 trillion, as you know, the last eight years they borrowed more than it did in the whole history of our country, so they borrowed more than $10 trillion — and yet, we picked up $5.2 trillion just in the stock market,...

Read More »The Future of Active Management

Share the post "The Future of Active Management"Here is a great debate on active vs passive investing between Barry Ritholtz and Nir Kaissar. Go have a read and let me know what you think about it in the forum. But before you do that here’s what I think the future of active management will look like.I started writing about the myth of passive investing several years ago.¹ At the time this was a pretty controversial idea. So controversial that, when I tried to explain it in the popular...

Read More »Congratulations Richard Thaler!

Share the post "Congratulations Richard Thaler!"Richard Thaler has won the Nobel Prize in economics which is very awesome. Thaler is a cool dude. Not only is he a master academic, but Thaler is a market practitioner as well. He’s among the small group of people in this world who do a lot of theorizing about how the economy works, but also backs it up by running a pretty big asset management firm.Thaler has an insane 110,000 citations on Google Scholar which shows how broadly influential his...

Read More »All In or All Out?

Share the post "All In or All Out?"I love this line from a recent John Bogle interview:“One thing that I strongly urge: Don’t ever, ever, ever if you’re an investor think of being out of the market or in the market,”Bogle is discussing the “fully valued” nature of today’s stock markets and advocating slight changes to one’s allocations. He says it’s okay to reduce your stock market exposure a little bit to offset the potential for higher risk. This is an approach I fully endorse. I think...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism