Bitcoin has gone stratospheric in recent weeks and it seems to be one of the only things anyone is talking about anymore. If you’re like most people you probably don’t know what Bitcoin is or if you do you don’t own any (or very much) in the first place. But you’ve probably read reports about how it’s the next world changing technology or you’re hearing from friends about how they made money investing in Bitcoin and now you’re jealous and the fear of missing out is creeping in. According...

Read More »Is the US Economy About to Boom?

Back in 2007 Edward Leamer published a paper titled “Housing IS the Business Cycle“. This one turned out to be pretty timely as the paper was published as the housing market was already falling apart and slowly pulling the US economy into the dumpster with it. It’s an appealing perspective especially within the context of today’s weak economic growth. With a weak recovery in housing the national recovery looks weak. So goes housing, so goes the US economy. Today’s release of the surge in...

Read More »THANKS!

It’s Thanksgiving in the USA (well, in 10 minutes it is) and I just wanted to reach out and say thanks to everyone who reads and contributes to this website. I’ve tried my best over the years to create a place for friendly, objective and educational content. But it wouldn’t exist if people didn’t read it. So thanks to everyone who reads, writes comments, sends emails and pushes me to learn more and hopefully give some of that education back. And on a more serious note, if you’re reading...

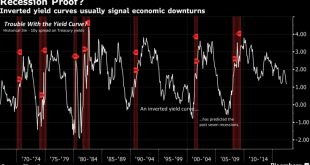

Read More »What’s the Yield Curve Really Telling Us?

The yield curve is a wonderful predictor of future recessions. In fact, it’s predicted all 7 of the last recessions in the USA. In a general sense this is a signal that there’s a disconnect between what Central Banks believe and what bond markets believe. Since Central Banks can control short-term rates with precision they can assert control on overnight rates in anticipation of future economic conditions.¹ But the yield curve will typically invert when long bond investors believe growth...

Read More »When Tail Risk isn’t Tail Risk

Half of the battle in portfolio management is wading through the sea of BS narratives that we are bombarded with on a daily basis. Knowing which narratives to avoid can be even more important than knowing which narratives are actually useful. Many of the stories I write here involve me thinking out loud about much of this BS. So I had a good chuckle when I saw this list of “tail risks” from the most recent Merrill Lynch Fund Managers Survey (I added the lovely “wrong” column and I was...

Read More »Portfolio Managers as Personal Trainers

Good investing is a lot like good health/fitness. We all basically know how to get fit and healthy – eat the right foods, workout regularly, etc. We also know how to succeed in investing – diversify, keep your fees low, don’t be too active. But investing can be really hard for the same reason that being healthy is hard – It’s difficult to stay disciplined. The world of asset management is undergoing a huge sea change. The data clearly shows that more active managers do not beat the market...

Read More »Fine Art and the Capitalist’s Conundrum

Share the post "Fine Art and the Capitalist’s Conundrum"Capitalism inherently veers towards a monopolistic and unequal society (ie, capitalists try to own all the means of production). This means that capitalists must understand that their own actions are the biggest risk to the system they love. This is because the labor class will not likely allow a persistent inequality to exist. This can either resolve itself via government action (greater redistribution) or the capitalists can resolve...

Read More »Is Robert Shiller Right That Passive Investing is Dangerous?

Share the post "Is Robert Shiller Right That Passive Investing is Dangerous?"Here’s an interview on CNBC from this morning wherein Robert Shiller argues that passive investing is a dangerous form of free loading. Now, I’m no Nobel Prize winner in economics, but I do raise chickens so I feel like I am fairly qualified to speak on this matter.¹ Let’s see if we can hash this out.I’ve written about this a lot and for good reason. I work in an industry that has mastered the art of selling useless...

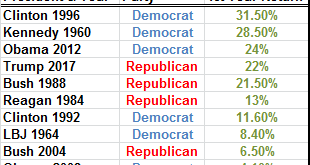

Read More »Your Politics are Hurting Your Investments

Share the post "Your Politics are Hurting Your Investments"Few things will destroy a portfolio as quickly as politics. For instance, exactly one year ago Donald Trump won the Presidency and a lot of people assumed that the world was ending as a result. Even very smart people like Paul Krugman made dramatic claims such as the following:“It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?Frankly, I find it hard to care much,...

Read More »Go FANG Yourself

Share the post "Go FANG Yourself"Bull markets are annoying. Not because I hate making money. I like making money. But they’re annoying because the whole time the stock market is going up there is a group of people making excuses for why it’s all irrational. Consider this list of narratives for instance:Quantitative Easing manipulated stock prices.Low interest rates manipulated stock prices.Buybacks are the only market driver.Low volume means a crash is imminent.High frequency trading will...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism