At least to this observer, Europe and the U.S. bring to mind the fumbling and growing desperation that Japan went through during the long period of political instability before strongman Abe arrived. To turn modern monetary theory into practice, you need functioning and decisive fiscal coordination and plans that go beyond the expediencies of annual budget cycles or election cycle pork-barreling. No fiscal policy vision, no fiscal dominance... make no mistake! Abe-Aso-Kuroda do know what...

Read More »Money From Nothing: Democrats’ Socialism for Free — Richard Porter,

This is interesting from the point of view of evolution of MMT criticism.It's not the same old "printing money" argument but a refurbished one that at least attempts to get what MMT says, even though it fails. I think that it is more likely ill-informed rather than intentional caricature.But it does indicate that the opposition is realizing that it has to deal with MMT in a way that appears serious rather than back of the hand, just dismissing as "obvious" nonsense.So I would count this as...

Read More »Bill Mitchell — ECB confirms monetary policy has run its course – Part 2

This is Part 2 of my two-part commentary and analysis of the – Monetary policy decisions – by the ECB (September 12, 2019). In Part 1, I discussed the shifts in the deposit rate and the changes to the Targeted longer-term refinancing operations (TLTROs). In Part 2, I am focusing on the decision to introduce a two-tiered deposit rate on excess reserves, which is designed to reduce the costs of the penalty arising from the negative deposit rate regime that the ECB has had in place since June...

Read More »U.S. home construction

More bearish news.... oh... wait a minute...U.S. home construction surged in August to the fastest pace since mid-2007 https://t.co/s380TLPrLB— Bloomberg (@business) September 18, 2019

Read More »FT Open Day

FT Open day today where you can read lots of articles for free.https://www.ft.com/the-big-read

Read More »Martin Wolff – why rentier capitalism is damaging liberal democracy

Economies are not delivering for most citizens because of weak competition, feeble productivity growth and tax loopholes I haven't been able to read a FT article for two weeks, but today the paywall let me in. FT must allow people to read an article for free from time to time. This is an excellent article describing what is wrong with present capitalist system, and it goes over a lot of different areas.Martin Wolff describes the feedback loop where certain companies can attract the best...

Read More »Frances Coppola – If You Don’t Understand Banks, Don’t Write About Them

Many economists don't understand how the banking system works, says Frances Coppola, and go on to write inaccurate books or give ill advice to governments. Here, in this article, she severely criticises a prominent economist for writing such a misinformed book.One thing MMTers are pretty clued up on is how banking works, and yet many economists - who don't understand how banks work at all - criticise MMT.The author, a young economist with a first-class degree from Oxford, the famous English...

Read More »Why is “millennial socialism” on the rise? Because liberalism is failing — Lea Ypi

Should be "neoliberalism" instead of "liberalism."New StatesmanWhy is “millennial socialism” on the rise? Because liberalism is failing Lea Ypi

Read More »Saudi Arabia oil output back to normal

Complete scam...Saudi Arabia says oil output back to normal soon; crude prices plunge https://t.co/NT5SY0WBk8— Savannah Now (@SavannahNow) September 18, 2019

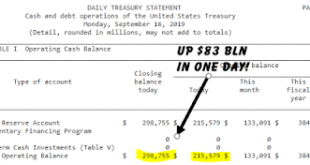

Read More »Reserves collapse

Still lingering effects of "debt ceiling!" now causing a sudden collapse in Reserve Assets as Treasury seeks to quickly increase the General Account to $350b...Treasury could have done a better job in August post the suspension of the "debt ceiling!" ... by increasing net issuance sooner and more evenly on a weekly basis... instead these morons have delivered EVEN MORE chaos... and have had to do a special repo operation for some institutions that apparently have become deficient in...

Read More » Mike Norman Economics

Mike Norman Economics