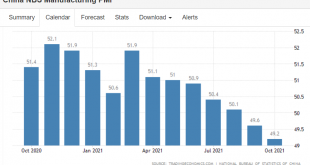

Still way down: I like the headline but the chart not so much: China Services PMI Rises to 3-Month High The Caixin China General Services PMI increased to 53.8 in October 2021 from 53.4 in the prior month, pointing to the second straight month of expansion in the service sector and the steepest pace since July as COVID-19 outbreaks eased. New orders expanded the most in three months, export sales returned to growth, and employment rose for the second month in a row....

Read More »Optimism index, Consumer sentiment, port congestion, lumber, iron ore, coal, steel, soybeans

Apparently ports are clearing:https://www.cnbc.com/2021/11/01/commerce-secretary-gina-raimondo-sees-clear-improvements-happening-at-congested-us-ports.html Several commodities seem to have peaked and then fallen back.Inflation is a continuous increase in the price level, so it doesn’t seem like that’s yet the case:

Read More »China, Brazil manufacturing, US Construction Spending, coal

Seems a global thing: No recovery here: Another price reversal: GC Newcastle coal futures tumbled by over 30% to $150 per metric ton, the lowest in three months, and are more than 40% below a record high of $269.5 hit on October 5th, as China stepped up policies to boost output ahead of the winter season. China’s average daily output increased by over 1.2 million tonnes to a record at above 11.6 million tonnes on October 18th. As a result, Chinese power plants now have...

Read More »GDP, Unemployment claims, China coal

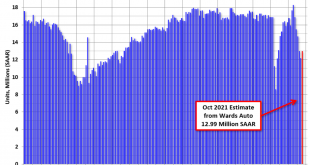

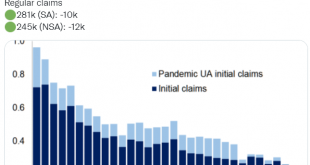

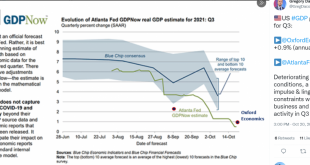

Deficit spending as a % of GDP heading south fast: US GDP Growth Disappoints The American economy expanded an annualized 2% on quarter in Q3 2021, well below market forecasts of 2.7% and slowing sharply from 6.7% in Q2. It is the weakest growth of pandemic recovery as an infusion of government stimulus continued to fade and a surge in COVID-19 cases and global supply constraints weighted on consumption and production. Gov’s saving money as claims fall: Transitory?...

Read More »Trade, durable goods orders, iron ore

More reason for a fiscal adjustment that’s not happening: These are new orders so the slowing isn’t about supply issues: Lots of commodity charts looking something like this- post covid spikes fading most everywhere:

Read More »Chicago Fed, gasoline consumption, miles driven, new home sales

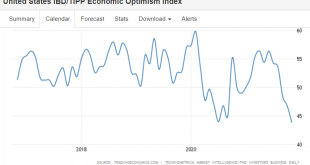

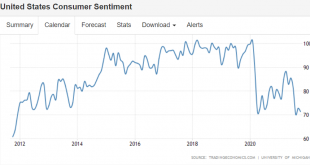

This seems to be holding up, though not yet back to pre covid levels: Up a bit from last month, but still looking weak:

Read More »Q3 GDP forecast, federal benefits, existing home sales

Not good. GDP heading toward recession: Now down vs same month last year:

Read More »Industrial production, home builders index, housing starts, real estate loans

Weak again: A bit of improvement but still looking weak: No growth here: No sign that low rates have caused excess lending:

Read More »Consumer sentiment, oil prices, federal debt/GPD

Not looking good: Russians and Saudis now cooperating to set crude oil prices.Not good: Post covid fiscal contraction is underway and debt/gdp is forecast to fall a lot further.Most of the Federal assistance was the likes of unemployment benefits which havenow expired and new spending programs from Congress seem to be not happening,at least any time soon. Also, higher prices mean the inflation adjusted value of theoutstanding public debt falls which is a drag on private...

Read More » Mosler Economics

Mosler Economics