Another one of those small blip ups we’ve been seeing; US Factory Activity Posts 1st Growth in 6 Months The ISM Manufacturing PMI for the US jumped to 50.9 in January from 47.8 in December, beating market forecasts of 48.5. The reading pointed to the first increase in factory activity in six months. A recovery was seen for new orders, export orders and production and employment fell at a slower pace. In contrast, inventories dropped more and price pressures intensified....

Read More »Profits, Rails, Cass shipments, Air freight, Corporate hiring plans

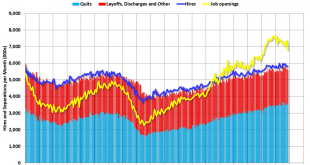

Bad: Bad: Bad: Fewer Companies Plan To Hire – More Economic Concerns

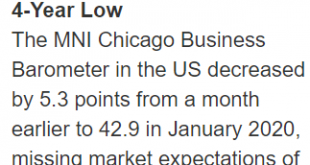

Read More »Chicago PMI, China, Euro area GDP, Personal income and expenditures

One blip up that reversed: Here’s another: And another: And another: This one blipped up, but with employment and income growth on the decline, don’t be surprised if it reverses in January:

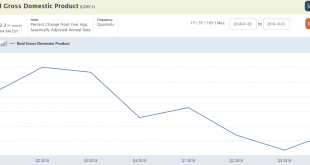

Read More »GDP, Philly Fed

A modest annual increase from 3 month ago’s report, but still looks to have been trending lower as the tariffs took effect: US GDP Grows 2.1% in Q4, Matches Forecasts The US economy grew 2.1% in Q4, the same as in Q3 and matching forecasts, advance estimates showed. The expansion was supported by consumer and government spending, residential fixed investment, and exports. In contrast, negative contributions came from private inventory investment and nonresidential fixed...

Read More »Pending home sales, Trade, Germany, Japan, US

Lots of surveys turning up a bit on hopes for the trade deal: And Japan passed a modest positive fiscal adjustment:

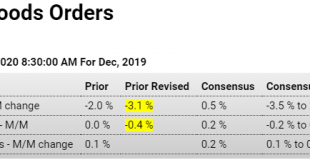

Read More »Durable goods, Richmond Fed

Downward revisions, and down when excluding military orders: Orders for defense aircraft and parts went up 168.3 percent, offsetting a 74.7 percent plunge in demand for civilian aircraft and a 0.9 percent fall in demand for motor vehicles and parts. Excluding transportation, new orders decreased 0.1 percent and excluding defense, orders dropped 2.5 percent. Also, new orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans,...

Read More »New Home Sales, Dallas Fed, Germany, Tech, Rails, Containers, Bank loans, Coronavirus

Doesn’t look like the lower rates are triggering any kind of housing boom…;) Still in contraction: Some of the recent moves higher may be reversing? Not at all good: Deceleration from tariffs continues: The catalyst that reverses the climb in equity valuations?

Read More »Jobs, Vehicle sales, Housing starts, Industrial production

Rolled over and heading lower: Rolling over and heading south: Had been rolling over but then this year end/good weather spike in December housing starts and lower rates probably worked to move activity forward from 2020. Permits had a small spike a bit earlier, and have since leveled off, and no house is built without a permit: Deeper into negative territory as tax cut tailwind shifted to tariff headwind:

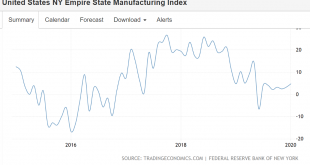

Read More »NY manufacturing, Market cap concentration, Private equity

Looks somewhat like the 2000 buildup: Private equity most often includes substantial new debt:

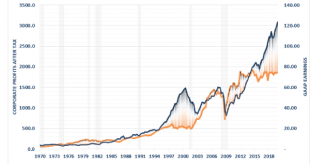

Read More »Earnings, Small business index

Earnings went up with the tax cuts but have decelerated sharply with the tariffs: Working its way lower as trumped up expectations recede only gradually:

Read More » Mosler Economics

Mosler Economics