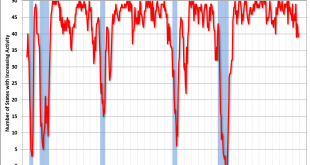

Going south fast since the tariffs: Tiny blip up from rate cuts seems to have reversed as real estate lending growth remains depressed: This is best thought of as the ‘net money supply’ or ‘the equity that supports thecredit structure:’

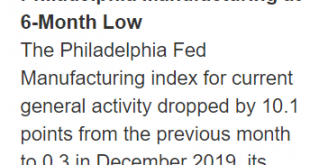

Read More »Philly Fed index, Fear and greed stats, Oil capex

The edge of recession? Fear and Greed Index Still contracting:

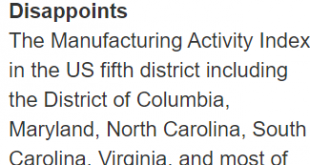

Read More »Richmond Fed, Chemicals barometer, Cass freight

Right back into contraction: Not looking so good:

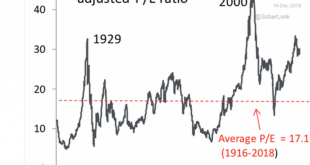

Read More »P/E ratios, Spending bill, Manufacturing, Claims chart

Looking like it will add some 10ths to GDP, depending on mulitples: Budget watchdogs howl over deficit-ballooning deals Measures tacked onto government spending bills this week will amount to $426 billion in lost revenue over the next decade Through q2:

Read More »Philly Fed, Existing home sales, Leading indicators, Spain, Rails

More bad news: Rolling over: Consensus Outlook The consensus for November’s index of leading economic indicators is an increase of 0.1 percent in what would follow three straight declines. Reversals for manufacturing and slowing in the labor market have been negatives for this index.

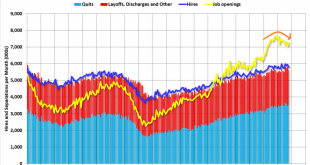

Read More »JOLTS, Fed lending survey, Tariff comment

Still rolling over:

Read More »Japan trade, Mtg purchase apps, Architecture index, Trump comment

Global trade collapse continues: Looks like more of same- L shaped recovery since the financial crisis: Still looking weak:

Read More »Housing starts, Industrial production, Bank loans, Euro business loan demand, Momentum

Yes, housing starts were up for the month, and somewhat higher than expected, but looking at the chart it sure looks to me like they’ve gone nearly flat with things like changes in the interest rate outlook causing some of the volatility. And on a population adjusted basis housing starts remain at about half of what they were in 2006: The growth in industrial production in general has been diminishing over the last few cycles, and most recently headed south due to the...

Read More »Business sales, Retail sales

Today’s trade agreement will do nothing to reverse the tariff induced deceleration well underway in the economy: This is through Q3:

Read More »Euro area IP, India IP, Japan, Mexico, US claims, Sea containers

The global slow motion train wreck continues: Japan: Core machinery orders in Japan, which exclude those of ships and electrical equipment, declined 6.0 percent from a month earlier in October 2019, following a 2.9 percent fall in September and compared with market expectations of a 0.9 percent increase. It marked the longest period of month-on-month contraction since a similar stretch to January 2009, mainly due to lower demand for fabricated metal products (-44.3...

Read More » Mosler Economics

Mosler Economics