China Total Vehicle Sales Vehicle sales in China tumbled 15.8 percent from a year earlier to 2.37 million in January 2019, following a 13 percent drop in the previous month. It was the seventh consecutive annual decrease in vehicle sales in the world’s largest auto market and the sharpest since January 2012 amid slowing economic growth. Still, new energy vehicle sales jumped 140 percent to 95,700 units, making the sector the best performing one among the whole automotive...

Read More »US retail sales, Fed comments

Starting to look more like most of the rest of the world: US retail trade fell by 1.2 percent from a month earlier in December 2018, following a revised 0.1 percent growth in November and missing market expectations of 0.2 percent gain. It was the steepest decline in trade since September 2009, as sales fell in almost all categories. Excluding automobiles, gasoline, building materials and food services, retail sales dropped 1.7 percent in December after an increase of 1...

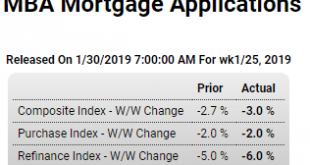

Read More »Mtg apps, Euro zone industrial production

Getting even more serious- year over year down 6%: Highlights The purchase index fell for a fourth straight week and down steeply, at a 6.0 percent rate which is not only the weekly change but also the yearly change as well. The report attributes the fall to “renewed uncertainty about the domestic and global economy” which it said held buyers off the market. But citing strength in the labor market, the Mortgage Bankers’ Association expects purchase activity to pick up in the...

Read More »NFIB survey, China, UK, California home sales, Rig count

Trumped up expectations fading: Highlights Doubts about future economic growth diminished optimism among small business owners to the lowest level in 26 months, according to the NFIB’s Small Business Optimism Index, which fell 3.2 points in January to 101.2, below consensus expectations as well as the range of analysts’ forecasts. Though still above the long-term average of 98, the optimism reading has retreated sharply from the 45-year high set last August, and the fall in...

Read More »Wealth share, Vehicle sales, US retail sales, US trade, German trade, HK index, UK, US Consumer credit

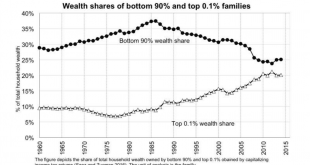

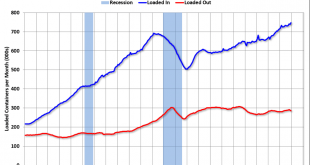

The ‘labor market’ is not a ‘fair game’ as people need to work to eat, and business only needs to hire if it likes the return prospects, so real wages should be expected to remain depressed without some form of outside support, which broke down in the 80’s with globalization policies, and the share of GDP going to capital began to rise: General weakness continues: US imports way down, as reflected in general global weakness, and same for weak US exports. And also indicative...

Read More »Private debt, Earnings, Small business confidence, Economic optimism index, My interview today

Looks like this source of private sector deficit spending may have been the driver behind about 1.5% of GDP growth, taking the place of bank lending. But most recently the growth looks to have slowed: US Q1 earnings tipped for first decline in 3 years (FT) Consensus estimates point to a 0.8 per cent drop in earnings per share this quarter, according to FactSet, a dramatic markdown from a forecast of 3.3 per cent growth at the end of December. With about half of the...

Read More »US factory orders, Euro zone retail sales, UK services, ISM NY, Lumber prices

Global retreat underway? US ISM New York Index at 7-Month Low in January

Read More »Euro zone, China, Amazon, US employment

Lots of headlines pointing to corporate weakness: Amazon sales outlook falls short after record holiday quarter (Reuters) Fast and free shipping helped the world’s largest online retailer boost revenue by 20 percent. Net income jumped 63 percent to $3 billion for the fourth quarter. Its international operating loss shrunk to $642 million in the quarter from $919 million a year earlier. The company forecast net sales of between $56 billion and $60 billion for the first...

Read More »News headlines- weakness continues, Mtg apps, Pending home sales, Confidence, ADP employment, MMT articles

Apple says China sales fell 27% last quarter (Nikkei) Apple’s net sales in greater China, including the mainland, Hong Kong and Taiwan, fell 27% on the year to $13.17 billion for the three months ended Dec. 29 in results announced Tuesday. This marked the first downturn there in six quarters. Combined sales elsewhere, including the U.S., Europe and Japan, grew 1% to $71.1 billion, pointing to China as the central cause of the sluggish quarterly results. Greater China as a...

Read More »Trade, China

Imports up, exports down: China’s December industrial profits fall for 2nd straight month (Reuters) Profits notched up by China’s industrial firms declined 1.9 percent from a year earlier to 680.8 billion yuan ($100.9 billion) in December. For the full-year of 2018, industrial profits increased 10.3 percent on an annual basis to 6.64 trillion yuan, versus the 11.8 percent gain in the January-November period, the National Bureau of Statistics (NBS) said on its website....

Read More » Mosler Economics

Mosler Economics