So André Lara-Resende, who I discussed here before, is again writing on the crisis of macroeconomics (in Portuguese and you might need to have a subscription), and now instead of embracing the Fiscal Theory of the Price Level (FTPL), has supposedly embraced Modern Money Theory (MMT). Many US MMTers cheered this as a demonstration of the reach of MMT in other countries. I would be less cheerful.Lara-Resende, let me explain to non-Brazilian readers, was a student of Lance Taylor at MIT, and...

Read More »MMT and its Discontents: Again (Wonkish and Longish)

Modern Monetary Theory (MMT) has been in the news again, and for good reasons. I actually had a post with the same title back in February of 2012, hence the again in the title. But now, with the irruption of Alexandria Ocasio-Cortez in the political scene ,and with the discussion of a Green New Deal (discussed here 7 years ago) and the feasibility of higher taxes (here, also long ago, among the many on the topic) taking the center of the political debate, MMT has become trendy. The rise...

Read More »Keynesian Economics: Back from the Dead

The Godley-Tobin Lecture by Bob Rowthorn, to be published by the Review of Keynesian Economics. [embedded content] Rowthorn suggests that many Keynesian features are part of the mainstream now, in particular showing a stable Phillips Curve without a natural rate. I remain more skeptical about the return of Keynesianism within the mainstream, but worth listening to his thoughts.

Read More »Inequality and Stagnation by Policy Design

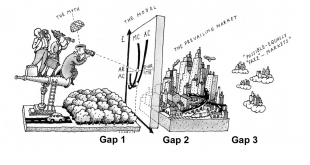

By Thomas Palley (guest blogger)This paper argues the mainstream economics profession is threatened by theories of the financial crisis and ensuing stagnation that attribute those events to the policies recommended and justified by the profession. Such theories are existentially threatening to the dominant point of view. Consequently, mainstream economists resist engaging them as doing so would legitimize those theories. That resistance has contributed to blocking the politics and policies...

Read More »Godley-Tobin Lecture – Friday 1st March11:30am – 12:45pm

Please note the change in date and venue. Bob Rowthorn's Godley-Tobin Lecture. titled “Keynesian Economics: Back from the Dead?” It will be Friday 1st March, in the Central Park West Room, at the Sheraton New York Times Square Hotel 11:30am - 12:45pm

Read More »On the unfolding coup in Venezuela

[embedded content] I recommend this video with an interview with Lucas Koerner that is in Caracas about the situation there on the Real News Network.

Read More »Still time to save the euro

New book edited by Herr, Priewe and Watt. Free download at the website (both pdf and for e-reader). I've only seen it now, and have been reading the great chapter by Cesaratto and Zezza. But look forward to others by Uxó, Álvarez and Febrero, Priewe, Bibow, Dullien, Simonazzi, Celi and Guarascio, and Bofinger to mention a few.Read full book here.

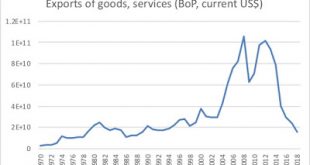

Read More »On the crisis in Venezuela

I wrote a few entries over the last few years that might be useful to understand what is going on in Venezuela. This one from 2016, tries to explain how the crisis is related to an old problem, the dependence on oil exports and the balance of payments constraint. Venezuela can't manage to get beyond the oil dependence in the boom, since a sort of Dutch Disease sets in. One can certainly blame the Chavista governments for not breaking with that dependence, but in all fairness conservative...

Read More »Bob Rowthorn’s Godley-Tobin Lecture

The Unreal Basis of Neoclassical Economics

By Al Campbell, Ann Davis, David Fields, Paddy Quick, Jared Ragusett and Geoffrey Schneideroriginally posted hereIntroduction Ten years after the financial crisis, we still find mainstream economists engaging in overly simplistic analysis that does not accurately capture the dynamics of the real world. People studying economics need to know that the principles of mainstream economics are hopelessly unrealistic. In this short article, we demonstrate that the ten principles of...

Read More » Naked Keynesianism

Naked Keynesianism