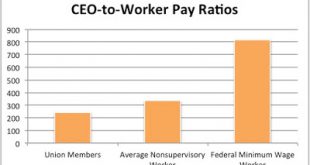

New data by the AFL-CIO Executive Paywatch, available here. Note that union members do much better than nonunion members, and certainly than minimum wage workers. For more context read this EPI report. You must admit that the use of flawed neoclassical thinking is sometimes amusing. In this Bloomberg post, an 'expert' (aka hired gun) from a free market think tank (pro-corporations propaganda machine) says that the "AFL-CIO study [is] 'useless' because it compares two different labor markets...

Read More »Philip Mirowski on Neoliberalism

Neoliberalism is resurgent in Latin America, and quite never left in the US anyway. And everything indicates that, either with Trump (yes, he does have a right-wing populist discourse, but I wouldn't take it too seriously; see his tax plan) or Clinton, it will continue to do well here, even if there is clearly a desire for change. This paper by Mirowski discusses the main points of Neoliberalism. A short reply by yours truly will be published soon in the INET website.

Read More »Boycott the Rio Olympics to Defend Brazilian Democracy

By Thomas PalleyTerrible anti-democratic events are now unfolding in Brazil with the constitutional coup against President Dilma Rousseff, organized through a cooked-up impeachment trial.The impeachment coup represents a naked attempt by corrupt neoliberal elements to seize power in Brazil. Make no mistake: it is a threat to democracy and social progress in Brazil, Latin America, and even the global community at large.If Brazilian voices concur, the world should respond by boycotting the Rio...

Read More »Brazilian coup and US misinformation

Brazil has an enormous past ahead As I suggested last month the coup had succeeded. Today Dilma Rousseff was effectively removed from the presidency. No real news here. I just want to correct, to some extent, the huge misinformation campaign in course in the US. Monica de Bolle was saying many incorrect things on NPR this week (for example, that "the origins of the program called Bolsa Familia came from actually Cardoso's government, so the previous government, the PSDB government that...

Read More »The great economic equations

A few days ago, Unlearning Economics twitted a link to an article on "The 17 equations that changed the world." Only one was an economic equation, The Black-Scholes one, and in all fairness it did not change the world, and is not even a central one in economics. First of all, Nassim Taleb has argued convincingly (for example, here) that Black, Scholes and Merton did not invent the formula, and what they really did was to provide a theoretical justification that was compatible with...

Read More »Latin American Corner: Quantitative easing, commodities, corporate debt and the paradox of debt

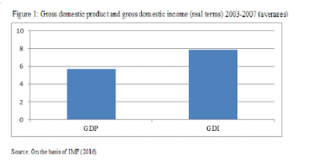

By Naked Keynes (Guest Blogger)The policy of quantitative easing (QE) pursued by the Federal Reserve following the fall of Lehman Brothers in September 2008 meant to lower long-term interest rates in the United States and boost expenditure had major effects on developing economies including in those of Latin America. As it is well know QE did not increase liquidity. The liquidity with which the Federal Reserve bought financial assets ended as excess reserves at the Federal Reserve balance...

Read More »Job numbers and more at the Rick Smith Show

[embedded content]

Read More »Jobs numbers and slow recovery

Jobs report (BLS, Employment Situation Summary) confirms a relatively weak month in April with total nonfarm payroll employment increasing by 160,000. Also, the labor force participation rate decreased and the employment-population ratio both decreased a bit. Mining employment continued to decline, something that Trump promised to reverse and Clinton noted there might not be much we can do about (the implications might not be minor, see here). Also, while unemployment remains at 5% a broader...

Read More »Robert Paul Wolff on Marx

[embedded content] Robert Paul Wolff always worth. Should read his Understanding Marx. He surprisingly says that Analytical Marxism has taken over Marxism. To get to Marxism he had to learn economics, the classical political economy of the Ricardian kind, and learn linear algebra. Hegelianism was not really central to the message (in my view, but he does say he hates Hegel). Labor Theory of Value explained, but he does not discuss Piero Sraffa's contributions directly here. There is no way...

Read More »An alternative for Greece

Nikolaos Bourtzis (Guest blogger)There we have it again. Another one of those clashes between Greece’s creditors and the Greek government. For the millionth time, the Troika, I’m sorry I mean the institutions, are demanding that Greece comes up with policy suggestions that could bring in 3.6 billion approximately in fiscal savings.This time, though, is different because these are going to be a “just in case” package, a buffer in case the government misses its fiscal targets. The government...

Read More » Naked Keynesianism

Naked Keynesianism