from Asad Zaman In part 1 of this article (Understanding Macro: The Great Depression (1/3), we saw that Keynes challenged classical economics on many fronts. Against the classical idea that free markets will automatically eliminate unemployment, he argued that governments needed to adopt appropriate fiscal and monetary policy in order to create full employment, as a necessary condition for high economic growth. He also argued that money is not neutral, and that there is fundamental...

Read More »Decline of working hours over long-run

https://dunstewart.wordpress.com/tag/work/

Read More »Schumpeter — an early champion of MMT

from Lars Syll Evidently this phenomenon is peculiar to money and has no analogue in the world of commodities. No claim to sheep increases the number of sheep. But a deposit, though legally only a claim to legal-tender money, serves within very wide limits the same purposes that this money itself would serve. Banks do not, of course, ‘create’ legal- tender money and still less do they ‘create’ machines. They do, however, something—it is perhaps easier to see this in the case of the issue...

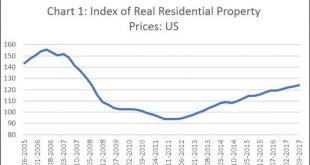

Read More »The return of a Housing Bubble – (4 graphs)

from C. P. Chandrasekhar and Jayati Ghosh Even while optimistic assessments of growth trends in the global economy proliferate, concerns that the unwinding of inflated asset price markets could abort the recovery are being expressed. Interestingly, there appears to be a substantial degree of agreement on the cause for such uncertainty, which is an excessive dependence on monetary measures in the form of quantitative easing and the associated extremely low interest rate environment to...

Read More »Utopia and markets

from David Ruccio Maarten Vanden Eynde, The Invisible Hand (2015)* We hear it all the time. On a regular basis. Having to do with pretty much everything. Why is the price of gasoline so high? Mainstream economists respond, “it’s the market.” Or if you think you deserve a pay raise, the answer again is, “go get another offer and we’ll see if you’re worth it according to ‘the market’.” Alternatively, if you want to solve a particularly pressing problem—such as climate change,...

Read More »Dean Baker: Protecting Family Health & The Environment

Dean Baker - 11:54

Read More »Welcome, Day 1 Routt Reigart, Dean Baker, Jay Feldman

Dean Baker: 2:20

Read More »A short note on the production boundary of neoclassical macro models

The neoclassical macro ‘DSGE’ models do not seem to have a rigorous model consistent ‘production boundary’. A ‘prior’ in macro economics is the production boundary: what are we talking about? Famously, Adam Smith more or less excluded services – or at least services from personal servants. While the present national accounts basically include everything which yields a monetary income, including illegal activities. The phrases ‘more or less’ and ‘basically’ of course indicate that...

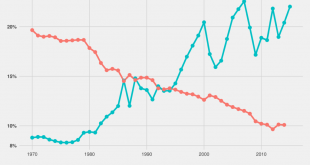

Read More »Income inequality 1970 – 2015: USA and France compared

Source: https://blog.raulza.me/wealth-and-income-inequality-data/

Read More »Oh dear, oh dear, Krugman gets it so wrong, so wrong

from Lars Syll Economics is a science of thinking in terms of models joined to the art of choosing models which are relevant to the contemporary world. It is compelled to be this, because, unlike the typical natural science, the material to which it is applied is, in too many respects, not homogeneous through time. The object of a model is to segregate the semi-permanent or relatively constant factors from those which are transitory or fluctuating so as to develop a logical way of...

Read More » Real-World Economics Review

Real-World Economics Review