Tomorrow will be the 200th anniversary of Marx. A lot of people write about this. The most interesting pieces I read were by Veblen (1906 part 1 and part 2). Some excerpts (the beginning of part 1 and the end of part 2, as always with Veblen one has to read the whole thing). One of the main points of Veblen is that Marx takes the ideas of ‘bourgeois’ economists more serious than these economists themselves, culminating among other things in the idea that, in an economics sense, ‘capital’...

Read More »The Pareto Efficiency Swindle

from Asad Zaman This continues a sequence of posts explaining how conventional economics is actually the economic theory of the top 1%: ET1%: Blindfolds created by Economic Theories. Eight central concepts of economic theory are shown to be deceptive – they have an appearance of objectivity, fairness, and equity, but actually conceal a strong bias in the favor of the wealthy. The previous post was the “Illusion of Scarcity.” We call the concept of “Pareto Efficiency” a swindle because it...

Read More »Dialogos: economics education and pedagogy. An interview with Peter Söderbaum

from Maria Alejandra Madi Malgorzata Dereniowska: Welcome to “Dialogos: Economics Education and Pedagogy,” Peter! In this interview we will focus on the questions of institutional change in economics education system, economic pedagogy and social responsibility of universities. Could you tell me something about your background and your professional experience as a teacher of economics? Peter Söderbaum: As a student at Uppsala University I became interested in political science, economics...

Read More »Financial regulations

from Lars Syll A couple of years ago, former chairman of the Fed, Alan Greenspan, wrote in an article in the Financial Times, re the increased demands for stronger regulation of banks and finance: Since the devastating Japanese earthquake and, earlier, the global financial tsunami, governments have been pressed to guarantee their populations against virtually all the risks exposed by those extremely low probability events. But should they? Guarantees require the building up of a buffer...

Read More »Trump’s Trade War

from C. P. Chandrasekhar After a year of huffing and puffing, President Donald Trump has launched, since January this year, what some are terming a trade war—fought in scattered industrial and selected locations. It started with quotas and tariffs on solar panel and washing machine imports, but then moved menacingly to steel and aluminium. Tariffs on these two products have been imposed under a WTO clause relating to imports that threaten national security, even while Trump’s rhetoric...

Read More »MMT — the Wicksell connection

from Lars Syll Most mainstream economists seem to think the idea behind Modern Monetary Theory is something new that some wild heterodox economic cranks have come up with. New? Cranks? How about reading one of the great founders of neoclassical economics — Knut Wicksell. This is what Wicksell wrote in 1898 on ‘pure credit systems’ in Interest and Prices (Geldzins und Güterpreise): It is possible to go even further. There is no real need for any money at all if a payment between two...

Read More »Amazon gets into the counterfeiting business

from Dean Baker Not really. The Guardian has an article that begins by telling readers how Amazon produces a copy of a designer laptop stand and sells it for half the price as the designer stand. While the article correctly refers to the Amazon product a “knockoff,” in other contexts, such as when discussing Chinese copies of US products, these copies are often referred to as “counterfeits.” This is not just a question of semantics. With a counterfeit, the buyer is being deceived. They...

Read More »European Appeal – companies and employees – blazing a new European trail

from Olivier Favereau Something has gone wrong in the European Union. Four examples bear witness to this dysfunction. How can it be justified that hundreds of thousands of letter-box companies have been allowed to develop, when the aim of these ghost companies is to evade taxes, labour laws and regulations? How can it be explained that European Court of Justice decisions authorized the restriction of employees’ fundamental rights in order to support business schemes whose very objective...

Read More »Inequality and fairness

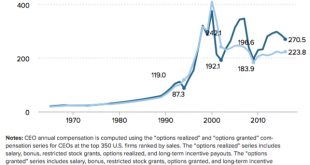

from David Ruccio While Amazon let it slip last week that its Prime program—the annual membership that offers discount pricing and free 2-day shipping—now tops 100 million members, there’s another number people might be curious about: the company’s average annual wage, which Amazon revealed in compliance with a new regulation that asks companies to show a comparison between an average worker’s wage and the salary of their CEO. Amazon has reported an average compensation for its...

Read More »The future of work is now

from Peter Radford The future of work has become one of the most hotly debated and analyzed topics of the past couple of years. No one with a pretension of a serious nature or a desire to be seen opining on the “big” issues can afford not to have a point of view on it. Thus we are bombarded by an endless torrent of articles, books, academic papers, and speeches on the way in which the workplace will be changed by the emergence of various technologies. The usual umbrella under which these...

Read More » Real-World Economics Review

Real-World Economics Review