from Lars Syll Both approaches to DSGE macroeconometrics (VAR and Bayesian) have evident vulnerabilities, which substantially derive from how parameters are handled in the technique. In brief, parameters from formally elegant models are calibrated in order to obtain simulated values that reproduce some stylized fact and/or some empirical data distribution, thus relating the underlying theoretical model and the observational data. But there are at least three main respects in which this...

Read More »Progress, farmers and the government – no easy solutions.

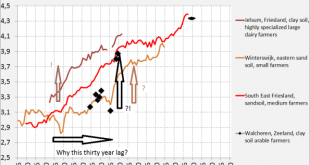

I’ve always been wondering why small farmers enjoying ‘Fair Trade’ privileges are not modernizing faster in the sense that they invest and modernize, capture the market and do not need ‘us’ anymore. Yes, I know that many international trade rules are not exactly fair. And the words ‘Banana republic’ and ‘Banana wars‘ come from somewhere – the official phrase for such ‘politically enforced’ global value systems is ‘empire‘ (TTIP anyone?). But even then – why do many small farmers and even...

Read More »The irresponsibility of fiscal responsibility

from Dean Baker It’s official: New York Times columnist David Leonhardt pronounced the Democrats as the party of fiscal responsibility. In contrast to three of the last four Republican presidents who raised deficits with big tax cuts for the rich and increases in military spending, the last Democratic presidents sharply reduced the budget deficit during their term in office. Leonhardt obviously intends the designation to be praise for the party, but it really shows his confusion about...

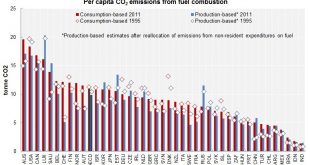

Read More »The Big Five: Australia, USA, Canada, Luxembourg and Saudi Arabia

source: http://www.oecd.org/sti/ind/carbondioxideemissionsembodiedininternationaltrade.htm

Read More »Utopia and macroeconomics

from David Ruccio From the beginning, mainstream macroeconomics has been a battleground between the visible and the invisible hand. Keynesian macroeconomics, represented on the left-hand side of the chart above, has an aggregate supply curve with a long horizontal section at levels of output (Y or real GDP) below full employment (Yfe). What this means is that the aggregate demand determines the actual level of output, which can be and often is at less than full employment (e.g., when AD...

Read More »Oxfam report on the rich-poor divide

The illusion of scarcity

from Asad Zaman (continuation of previous post on ET1%: Blindfolds Created by Economic Theory) Economists have performed an amazing piece of magic, successfully creating a mass deception which has taken in the vast majority of the population of the world. Seeing through this complex and sophisticated trick requires separating, studying and understanding many different elements which all combine to create this illusion. One of the elements is a binary theory of knowledge, according to...

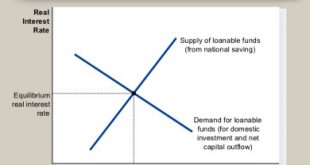

Read More »The loanable funds fallacy

from Lars Syll The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credits set by banks and determined by supply and demand — as Bertil Ohlin put it — “in the same way as the price of eggs and strawberries on a village market.” It is a beautiful fairy tale, but the problem is that banks are notbarter institutions that transfer pre-existing loanable...

Read More »Trends of bottom 50% income share: USA and China versus France

new issue of Economic Thought

Economic Thought, vol. 7, no. 1download issue in full Spiethoff’s Economic Styles: a Pluralistic Approach?Sebastian Thieme The Backward Induction Controversy as a Metaphorical ProblemRamzi Mabsout Reassessing Marshall’s Producers’ Surplus: a Case for ProtectionismDaniel Linotte The Decline of the ‘Original Institutional Economics’ in the Post-World War II Period and the Perspectives of TodayArturo Hermann Comments on Arturo Hermann’s paper, ‘The Decline of the “Original...

Read More » Real-World Economics Review

Real-World Economics Review