from Lars Syll What does concern me about my discipline … is that its current core — by which I mainly mean the so-called dynamic stochastic general equilibrium approach — has become so mesmerized with its own internal logic that it has begun to confuse the precision it has achieved about its own world with the precision that it has about the real one … While it often makes sense to assume rational expectations for a limited application to isolate a particular mechanism that is distinct...

Read More »Cashlessness poses a challenge to democracy itself.

The Indian experience suggests that the obsession with digital transactions as a marker of social and material progress may be misplaced and even counterproductive. Indeed, policy attempts to push a rapid transition to cashlessness may be both infeasible and regressive. Cashlessness relies on very substantial development of infrastructure, universal access to banking, and strong and reliable internet connectivity — and while it provides convenience, it also can lead to greater monitoring...

Read More »Utopia and populism

from David Ruccio Much has been made of the rise of populism in recent years and the threat it poses to liberal democracy. My view is that liberal critics of populism, standing on their heads, get it wrong. If made to stand on their feet, they’d have to admit that populism actually represents the failure of liberal democracy. Populism has experienced a resurgence of late—in Hungary, Britain, France, Turkey, the United States, and elsewhere—especially the form of populism variously...

Read More »The text in which Thorstein Veblen introduced the phrase ‘neo-classical’

On this blog neoclassical economics are regularly discussed. Thorstein Veblen is credited with introducing, around 1900, the phrase ‘neo-classical’ (see the excerpt below). A lot of his criticisms of neo-classical authors still apply today: they assume what they should explain. The Keynes in the text is the father of John Maynard Keynes. Veblen was a very talented writer – which shows when you read the excerpt (and the entire text) twice. From the website of the AFEE. Of the foundations...

Read More »It’s high time to bury Milton Friedman’s natural rate hypotheis

from Lars Syll Fifty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy and that (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation. The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the ideas that unemployment really is independent of monetary policy and that...

Read More »Time in economic theory

from Frank Salter and RWER issue 81 Despite economic cycles being the norm from the beginnings of the industrial revolution, major areas of economic thought present equilibrium as an appropriate basis for analysis. Blaug (1998, p.23) comments “indeed real business cycle theory is, like new classical macroeconomics, a species of the genus of equilibrium explanations of the business cycle (which would yesteryear have been considered an oxymoron).” The formal treatment of time is eschewed....

Read More »What is (wrong with) neoclassical economics?

from Lars Syll If you want to know what is “neoclassical economics” and turn to Wikipedia you are told that neoclassical economics is a term variously used for approaches to economics focusing on the determination of prices, outputs, and income distributions in markets through supply and demand, often mediated through a hypothesized maximization of utility by income-constrained individuals and of profits by cost-constrained firms employing available information and factors of production,...

Read More »Keynes and econometrics

from Maria Alejandra Madi After the 1920s, the theoretical and methodological approach to economics deeply changed. Based on a criticism of Marshall’s work and legacy, a new generation of American and European economists developed Walras’ and Pareto’s mathematical economics. As a result of this trend, the Econometric Society was founded in 1930. The constitutional assembly was held in Cleveland, Ohio, during the annual joint meeting of the American Economic Association and the American...

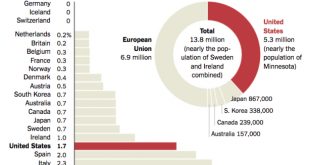

Read More »Dystopia and global poverty

from David Ruccio And as Angus Deaton reminds us, those struggling to survive in conditions of extreme poverty aren’t just “over there,” in the Third World. Notwithstanding the focus of the World Bank-sponsored campaign to eradicate extreme poverty and the ubiquitous appeals on behalf of the needy in poor countries, a large portion—approximately 14 million people—live in wealthy countries—some 5.3 million in the United States alone. Is there any more damning condemnation of contemporary...

Read More »On probabilism and statistics

from Lars Syll ‘Mr Brown has exactly two children. At least one of them is a boy. What is the probability that the other is a girl?’ What could be simpler than that? After all, the other child either is or is not a girl. I regularly use this example on the statistics courses I give to life scientists working in the pharmaceutical industry. They all agree that the probability is one-half. So they are all wrong. I haven’t said that the older child is a boy. The child I mentioned, the boy,...

Read More » Real-World Economics Review

Real-World Economics Review