from June Sekera More than a century ago, the effective operation of the public economy was a significant, active concern of economists. With the insurgence of market-centrism and rational choice economics, however, government was devalued, its role circumscribed and seen from a perspective of “market failure.” As Backhouse (2005) has shown, the transformation in economic thinking in the latter half of the 20th century led to a “radical shift” in worldview regarding the role of the state....

Read More »The flawed premises of mainstream economic theory

from Lars Syll You know, and I know, that we do not live in a world of Econs. We live in a world of Humans. And since most economists are also human, they also know that they do not live in a world of Econs … Nevertheless, this model of economic behavior based on a population consisting only of Econs has flourished, raising economics to that pinnacle of influence on which it now rests. Critiques over the years have been brushed aside with a gauntlet of poor excuses and implausible...

Read More »Utopia and the economics of control

from David Ruccio I have often argued—in lectures, talks, and publications—that every economic theory has a utopian dimension. Economists don’t explicitly talk about utopia but, my argument goes, they can’t do what they do without some utopian horizon. The issue of utopia is there, at least in the background, in every area of economics—perhaps especially on the topic of control. Consider, for example, the theory of the firm (which I have written about many times over the years), which is...

Read More »Economath — a device designed to fool the feebleminded

from Lars Syll Many American undergraduates in Economics interested in doing a Ph.D. are surprised to learn that the first year of an Econ Ph.D. feels much more like entering a Ph.D. in solving mathematical models by hand than it does with learning economics. Typically, there is very little reading or writing involved, but loads and loads of fast algebra is required. Why is it like this? The first reason is that mathematical models are useful … A second beneficial reason is signalling....

Read More »George Soros’ INET, the Trojan horse of the financial oligarchy

from Norbert Häring Four years ago, I framed it as a question: “George Soros‘ INET: An institute to improve the world or a Trojan horse of the financial oligarchy?” Today I would not use a question mark any more.Frances Coppola came to a similiar conclusion after attending the big INET gathering in Edingburgh in October. On her blog Coppola reports about the conference of the Institute for New Economic Thinking, bankrolled initially by George Soros. He was joined by other hedge fund...

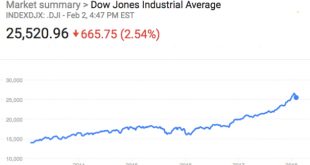

Read More »More thoughts on the stock crash

from Dean Baker Before anyone starts jumping off buildings, let me give you a few items to think about. 1) The stock market is not the economy. It moves in mysterious ways that often have little or nothing to do with the economy. In October of 1987 it plunged more than 20 percent in a single day. GDP grew 4.2 percent in 1988 and 3.7 percent in 1989. The market did recover much of its value over this period, but we don’t know whether or not it will recover the ground lost in the last week...

Read More »What goes up. . .

from David Ruccio Must come down. . . I’m not referring to karma or the application of Newton’s law of universal gravitation. No, it’s just the way capitalism works. Take the stock market, for example. Last Friday, the Dow Jones Industrial Average closed down 666 points, or 2.5 percent, its biggest percentage decline since the Brexit turmoil in June 2016 and the steepest point decline since the 2008 financial crisis. The large decline is really no surprise, since the U.S. stock market—a...

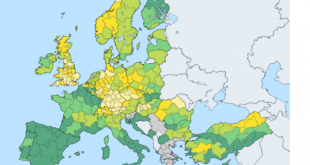

Read More »A pan-European living wage as a condition for authentic Freedom of Movement

From Yanis Varoufakis At the source a link to the UK House of Commons discussion where this idea was put forward can be found. Britain used to have wage councils that set the minimum wage per sector. Mrs Thatcher saw to it that they were abolished, together (effectively) with trades unions and council houses – thus yielding the present Precariat-Proletariat whose palpable anger and frustration is evident across the land. There is no doubt that we need to bring back a modernised for of...

Read More »Low unemployment rates are here again (at least in parts of Europe). Surprise (not): productivity increases, too.

It seems that at this moment in time lower unemployment does not lead to higher inflation but to increasing wages, lower profits and increasing productivity. Since 2008, the (European) world has been characterized by high unemployment, a double dip (2008-2013), a historically unprecedented stalling of productivity and low interest rates. This situation seems to be changing. Since 2014, employment is increasing and unemployment is declining. New growth sectors (like ‘information and...

Read More »The stock market plunges, a major blow against inequality!

from Dean Baker The stock market tumbled by 2.0 percent on Friday. Given that the top 1.0 percent hold a grossly disproportionate share of stock wealth, this means they took a big hit. Are we more equal as a society now? Those who like to focus on wealth measures on inequality would have to say yes. And if the market continues to fall (not a prediction, but it certainly is possible that the correction will continue) then we will see further gain on the inequality front. Suppose it falls...

Read More » Real-World Economics Review

Real-World Economics Review