from Maria Alejandra Madi Current food challenges involve issues ranging from land and food access to commodity price volatility, besides national and international regulation. Although the scope and intensity of these challenges vary according to the different economic and social situations of countries, the debate has been global. Today, once again, these issues arise deep concerns on behalf of the 2017 WTO ministerial conference that has just been closed, in Buenos Aires, Argentina....

Read More »Dean Baker on Mustang Town Center

Dean Baker on Little Axe

The Efficient Markets Hypothesis

from Lars Syll The really interesting questions about the Efficient Markets Hypothesis — at least when discussed by mainstream economists — usually drown in “the model is the message” pseudoscientific mumbo-jumbo of four-factor models with two mispricing factors being better-performing than three-factor models, blah, blah, blah … Diane Coyle has a much more accurate view of what it’s all about: I would defend using the assumption of rational choice as long as one realises that it is not a...

Read More »Bubbles: are they back?

from Dean Baker There has been much greater concern about the danger of asset bubbles ever since the collapse of the housing bubble sank the economy. While it is good that people in policy positions now recognize that bubbles can pose a real danger, it is unfortunate that there still seems very little understanding of the nature of the problem. First, an economy-threatening bubble does not just sneak up on us. Often the discussion of bubbles implies that we need some complex measuring...

Read More »William White: wrong about the future of central banking

“We too must bring into our science a strict order and discipline, which we are still far from having…by a disorderly and ambiguous terminology we are led into the most palpable mistakes and misunderstandings – all these failings are of so frequent occurrence in our science that they almost seem to be characteristic of its style.” – Eugen von Böhm-Bawerk (1891: 382-83) What William White writes about inflation is wrong, sloppy and seems a conscious effort to derail the discussion. Today...

Read More »Economic history — a victim of economics imperialism

from Lars Syll Economic history was one of the first fields to succumb at least partially to so-called economics imperialism, the phenomenon through which the methods and models of economic theory have taken over other social scientific subject fields. The economic historian’s craft, which probably always tended to err in any case towards retrospective reassurance that things were never as bad as they appeared at the time, was thus at least to some extent overwritten by the economic...

Read More »Central banking: Edward Harris on why raising interest rates in an overleveraged economy is very risky

Even more about central banking. Why so much? Partly because people are writing very good stuff about it (like the AAA piece from Edward Harris below (excerpt)). Partly because we seem to see the end of the era of ‘pure’ inflation targeting. And (part of this last trend?) partly because soon Merkel and Macron will sit together to redesign the Eurosystem. Previous posts: ideas of Willem Buiter, Richard Werner, Thomas Mayer excerpts from a recent paper by Mike Konczal and Josh Mason and...

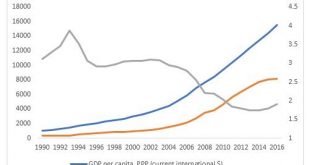

Read More »Do Purchasing Power Parity exchange rates mislead on incomes? The case of China

from C.P. Chandrasekhar and Jayati Ghosh Ever since Larry Summers and Alan Heston produced what become known as the “Penn World Tables” comparing prices and thereby the purchasing power of currencies across countries, the urge to use some deflator of market exchange rates to compare incomes across countries has been strong. The economic theory behind this is that exchange rate comparisons of less-developed economies consistently undervalue the non-traded goods sector, especially...

Read More »Don’t worry?!

from Daivd Ruccio Liberal mainstream economists all seem to be lip-synching Bobby McFerrin these days. Worried about automation? Be happy, write Laura Tyson and Susan Lund, since “these marvelous new technologies promise higher productivity, greater efficiency, and more safety, flexibility, and convenience.” Worried about the different positions in current debates about economic policy? Be happy, writes Justin Wolfers, and rely on the statistics produced by government agencies and...

Read More » Real-World Economics Review

Real-World Economics Review