from Dean Baker I’m glad to see the debate that Max Sawicky has touched off with his review of Steve Teles and Brink Lindsey’s new book, The Captured Economy: How the Powerful Enrich Themselves, Slow Down Growth, and Increase Inequality. The book, and the resulting debate, raises the question: can an attack on rent-seeking by the rich be the basis for a progressive agenda? This is a debate I’ve played some role in getting started, with several books, most recently Rigged: How...

Read More »On the non-applicability of statistical models

from Lars Syll Eminent statistician David Salsburg is rightfully very critical of the way social scientists — including economists and econometricians — uncritically and without arguments have come to simply assume that they can apply probability distributions from statistical theory on their own area of research: We assume there is an abstract space of elementary things called ‘events’ … If a measure on the abstract space of events fulfils certain axioms, then it is a probability. To...

Read More »What are business schools for?

from Robert Locke In his 1927 book, Julien Benda, wrote about the Treason of the Intellectuals (la trahison des clercs) One reviewer (Roger Kimball) noted: “From the time of the pre-Socratics, intellectuals were a breed apart. They were non-materialistic knowledge-seekers who believed in a universal humanism and represented a cornerstone of civilized society. According to Benda, this all began to change in the early twentieth century. In Europe in the 1920s, intellectuals began abandoning...

Read More »The ECB shadow council on the ideal ECB. Inflation targeting: out. Financial cycle: in.

Some years ago, Cladio Borio from the BIS introduced the ‘financial cycle’. Here, a Borio/Lowe paper from 2002. What’s the financial cycle? From the twenties of the twentieth century onwards Wesley Mitchell and the NBER (National Bureau of Economic Research) perfected the (monthly) measurement of the classical business cycle (a still ongoing project). The concept of this business cycle of the ‘flow’ economy was and is the cornerstone of much macro-economic theorizing. ‘Chicago style...

Read More »Shopping Frenzy in the New China

from C. P. Chandrasekhar In an otherwise gloomy world economic environment, a new kind of record given the media bizarre cause to cheer: the value of online sales notched up by Chinese e-commerce giant Alibaba on a single discount sales day. Global business headlines screamed that in its annual sale on Singles’ Day, 11 November 2017, Alibaba had registered a record sales value of 168.2 billion yuan or $25.3 billion. Singles’ Day, or 11 November, was, because of its 11/11 aspect,...

Read More »[977] Steve Malzberg & Dean Baker: GOP Tax Cut

Steve Malzberg, conservative TV and Radio host, and Dean Baker, Co-Director of the Center for Economic Policy Research, join Bart Chilton for a panel discussion on the latest GOP tax cuts. Is the United States ready for a cyber-attack? Todd Shipley joins us to discuss if the U.S. is ready for the cyber-threats of the future. Follow us on Twitter: https://twitter.com/RT_BoomBust https://twitter.com/LindsayFrance https://twitter.com/BiancaFacchinei Check us out on Facebook -- and feel free...

Read More »Consistency is the …

from Peter Radford Well, at least I am being consistent. Whether that’s being a good thing or not I will leave to you to figure out. David Brooks set me off on a rant a few days ago, and he’s doing it again. I have to stop reading his columns. Last time it was about the rotting Republican Party: Brooks is one of those people who realized way too late that the GOP of yore disappeared long ago and has been replaced by a mash-up of far right cause driven groups smeared together with a good...

Read More »More papers from WEA online conference – Economic Philosophy: Complexities in Economics

Complexity in the theory of economic evolution of Thorstein Veblen: an introductionJoão Vitor Oliveira da SilvaThorstein Veblen is a classic author, recognized for his writings on institutions and economic change. The complexity perspective, on the other hand, is a relatively contemporary approach for studying a considerable range of phenomena both in natural and social sciences. …More › 12 Comments › The evolutionary dimension of Hayek’s thought: cultural selection and spontaneous...

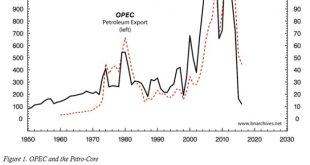

Read More »Profit warning: there will be blood

from Shimshon Bichler and Jonathan Nitzan We have just updated the charts in our 2014 RWER paper ‘Still About Oil?’, and the picture they portray reads like a capitalist call for arms. Beginning in the late 1980s, we suggested that, since the late 1960s, the Middle East was greatly influenced by the capitalized power of a Weapondollar-Petrodollar Coalition – a loose coalition comprising the leading oil companies, the OPEC cartel, armament contractors, engineering firms and large financial...

Read More »Mike Konczal and Josh Mason on the Ideal Central Bank

We’re publishing some expert ideas about the future of the ECB and monetary policy. Three days ago some ideas of Willem Buiter were published, two days ago some ideas from Richard Werner and yesterday ideas from Thomas Mayer. Today some excerpts from a recent paper by Mike Konczal and Josh Mason. They are not part of the Handelsblatt Shadowcouncil but their ideas often tally with those already published: Pure ‘inflation targeting’ is (mortally?) compromised Hence, central banks are...

Read More » Real-World Economics Review

Real-World Economics Review