from Lars Syll Important and far-reaching problems still beset regression analysis and econometrics — many of which basically is a result of unsustainable ontological views. Most econometricians have a nominalist-positivist view of science and models, according to which science can only deal with observable regularity patterns of a more or less lawlike kind. Only data matters and trying to (ontologically) go beyond observed data in search of underlying real factors and relations that...

Read More »Subjective probability does not exist

from Asad Zaman The title is an inversion of De-Finetti’s famous statement that “Probability does not exist” with which he opens his famous treatise on Probability. My paper, discussed below, shows that the arguments used to establish the existence of subjective probabilities, offered as a substitute for frequentist probabilities, are flawed. The existence of subjective probability is established via arguments based on coherent choice over lotteries. Such arguments were made by Ramsey,...

Read More »How low can they go?

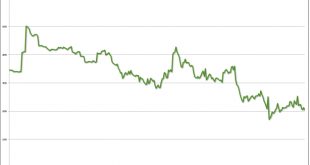

from David Ruccio One of the rationales for the great Republican tax heist of 2017 is that American corporations desperately need tax relief. However, as is clear from the chart above, the current corporate tax rate is already very low—not absolutely (since it was in fact lower in 2009, when corporate profits fell during the Great Recession), but certainly in comparison to the rest of the postwar period.* Today, the effective corporate tax rate in the United States is only 20.4 percent,...

Read More »The Victims of Game Theory

from Lars Syll Imagine you and someone you do not know can share $100. It is up to you to propose how to divide the $100 between the two of you, and the other player will need to accept or reject your proposal. If he rejects the proposal, neither of you will receive anything. What sum will you offer the other player? I have data on the choices of about 12,300 people, most of them students, who were asked this question. Nearly half of the participants (49%) offered the other player the...

Read More »How China is managing capital flows – and why

from Jayati Ghosh The global financial media are always on the lookout for signs of an impending financial crisis in China – and the dark prognostications about the future made by several external observers relate to both internal and external financial flows. But there are reasons to believe that both concerns may be overplayed, and that what is occurring especially with respect to cross-border flows is a much more complex process reflecting a medium-term plan of the Chinese state, in...

Read More »Lines

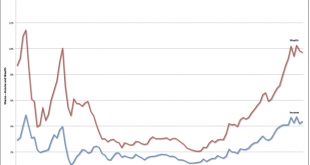

from David Ruccio How bad have things gotten in the United States? Nitin Nohria [ht: ja], the dean of Harvard Business School, is sounding the alarm that “class lines. . .have become far more distinct and visible in recent years.” Nohria published his essay at the end of the same week that the U.S. Senate passed its version of the “Tax Cuts and Jobs Act,” which is nothing more than an enormous boon to large corporations and wealthy individuals under the guise of trickledown economics, ...

Read More »Viewed as an element of scientific method, are tests for predictive power best seen as tests for the ability of a theory to predict?

from Adam Fforde Whilst it may superficially appear clear, an alleged ability of a theory to predict is easily shown to depend upon a host of tangled factors, so things are not clear at all. At an extreme, to start with, a theory that is right 51% of the time could feasibly be described as predictive, but is not likely to be. Yet if the point is to win bets placed very many times, then it could be thought of as predictive. Theories from physics, such a Newton’s laws of motion, are widely...

Read More »Denial of the public non-market system, and the consequences

from June Sekera The Denial Public non-market production makes up a quarter to a half or more of all economic activity among advanced democratic nation-states. Yet the public economy’s ability to function on behalf of the populace as a whole is seriously imperiled in many western democracies, and particularly jeopardized in the United States. The surging influence of mainstream economics has been a prime factor in the degradation of the public domain over the last several decades – a...

Read More »Why does capital flow from poor to rich countries? – The case of China

from Michael Joffe In 1978, not long after the death of Mao Zedong, economic reforms began to be implemented. The main changes were: (i) rural households were now allowed to keep their own surpluses (the “household-responsibility system”); (ii) Township and Village Enterprises were allowed to operate in a manner similar to capitalist firms; (iii) Special Economic Zones such as Shenzhen were set up, based on foreign capital and the export market; and (iv) State-Owned Enterprises were...

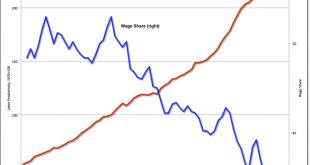

Read More »Trickledown economics—then and now

from David Ruccio Robert McElvaine, premier historian of the first Great Depression (whose books we have used to teach A Tale of Two Depressions), argues that Republicans today are repeating the same mistakes as the Republicans who were in charge during the 1920s, whose trickledown policies led to the spectacular crash of 1929. As a historian of the Great Depression, I can say: I’ve seen this show before. In 1926, Calvin Coolidge’s treasury secretary, Andrew Mellon, one of the world’s...

Read More » Real-World Economics Review

Real-World Economics Review