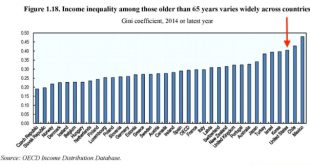

from David Ruccio Social Security may have decreased the rate of poverty among retirees in the United States.* But it certainly hasn’t solved the problem of inequality. As is clear from the chart above, from a recent report from the Organisation for Economic Co-operation and Development, old-age inequality among current retirees in the United States is higher than in all other OECD countries, except Chile and Mexico. But wait, it’s probably going to get worse. That’s because, within...

Read More »On Spain, Catalunya and former Yugoslavia

What I did not expect: In my lifetime I’ve seem countries in and around Europe disintegrate. The Soviet Union. Yugoslavia. Czechoslovakia. Iraq. Syria. And, work in progress, the UK. Spain seems to be next in line. In many fo these countries this process was accompanied by war. Vaclav Havel was the last president of Czechoslovakia and strongly opposed splitting up. Being a wise man, he resigned instead of using violence when he saw that it had become inevitable. Thanks to him we know that...

Read More »Twenty years ago

from Lars Syll Modern economics has become increasingly irrelevant to the understanding of the real world. In his seminal book Economics and Reality(1997) Tony Lawson traced this irrelevance to the failure of economists to match their deductive-axiomatic methods with their subject. It is — sad to say — as relevant today as it was twenty years ago. It is still a fact that within mainstream economics internal validity is what really counts and external validity is only rarely discussed. Why...

Read More »Speculation

from Peter Radford Robert Locke’s excellent discussion of the different perspective presented by a tacit-knowledge rather than explicit-driven driven enquiry into economic matters prompts me to reprise my understanding of the purpose of a business firm. Put briefly: a business firm exists to translate what is often called tacit knowledge in to what is called explicit knowledge. An alternative wording would be that firms take the ad hoc and various and make them into the codified and...

Read More »Balance this!

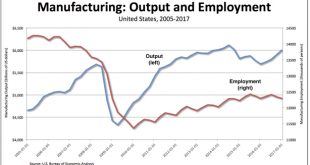

from David Ruccio Both Donald Trump and Eduardo Porter would have us believe the U.S. trade deficit is a serious problem—and that, if it can brought back into balance, jobs for American workers will be restored. Nonsense! Yes, I know, Trump’s attacks on free trade did in fact resonate among working-class voters. And, as I have argued, there is clear evidence that that a tiny group at the top has captured most of the benefits of trade agreements and other measures that have allowed U.S....

Read More »The ECB’s “well past”, but by how much?

From: Erwan Mahé 26 October 2017 I had no intention of writing before the ECB meeting today or, for that matter, afterward, given the already abundance of published opinion on the event. However, in light of the varied quality of the studies undertaken so far, I could not resist the temptation to return to my favourite topic, which is the study of the reaction function of central banks, especially, given the particular context faced by the European Central Bank. The only question we need...

Read More »Do unrealistic economic models explain real-world phenomena?

from Lars Syll When applying deductivist thinking to economics, neoclassical economists usually set up ‘as if’ models based on a set of tight axiomatic assumptions from which consistent and precise inferences are made. The beauty of this procedure is, of course, that if the axiomatic premises are true, the conclusions necessarily follow. The snag is that if the models are to be relevant, we also have to argue that their precision and rigour still holds when they are applied to real-world...

Read More »My evening with Joan Robinson and the Tractatus

from Edward Fullbrook The General Theory of Employment, Interest and Money was the first book I ever read with pleasure. I was 22. From age five to sixteen the school system had me classified as borderline mentally retarded. My luck changed in my penultimate year of high school when a non-conformist English teacher gave me the chance to pretend I was not mentally deficient. She also taught me how to write a sentence, after which, inflated with fantasises of normality, I taught myself...

Read More »Sapiential Economics

from Robert Locke Neoclassical economists insist that the formal system of knowledge they create takes precedence over what we learn through experience, on the grounds, as Erich Schneider wrote, “that the sea of facts is dumb and can only be forced to reveal interconnections when properly queried. Intelligent [sinnvoll] questions can only be derived from theoretical formal analysis.” (Bomback and Tacke, 37) But what if it were the other way around that formal knowledge systems are dumb...

Read More »The real costs of making (and using) money – the bitcoin waste

Bitcoins are a total waste. On this blog, I’ve written some posts on ‘the real costs of making money’ (a summary here). Producing money takes resources: labor, capital, land. One of the ’land’ aspects used to be silver and gold. Digging for gold and silver a social setting: the slaves in the silver mines of Larium (Athens), the native workers which perished in the high altitude silver mines of Cerro Ricco, Peru (the Spanish empire). Or ‘apartheid’, which guaranteed a steady flow of cheap...

Read More » Real-World Economics Review

Real-World Economics Review