from Edward Fullbrook Determinism, the idea that everything that happens must happen as it does and could not have happened any other way, and atomism, the idea that the world is made up of entities whose qualities are independent of their relations with other entities, are fundament components of classical mechanics. Atomism is also central to the concept of mind developed in John Locke’s An Essay Concerning Human Understanding, published (1690) three years after Newton’s Principia....

Read More »Haunted by surplus

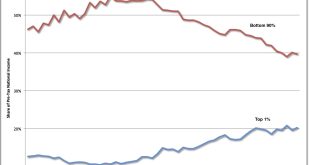

from David Ruccio Inequality in the United States is now so obscene that it’s impossible, even for mainstream economists, to avoid the issue of surplus. Consider the two charts at the top of the post. On the left, income inequality is illustrated by the shares of pre-tax national income going to the top 1 percent (the blue line) and the bottom 90 percent (the red line). Between 1976 and 2014 (the last year for which data are available), the share of income at the top soared, from...

Read More »Blaming inequality on technology: sloppy thinking for the educated

from Dean Baker The most popular explanation for the sharp rise in inequality over the last four decades is technology. The story goes that technology has increased the demand for sophisticated skills while undercutting the demand for routine manual labor. This view has the advantage over competing explanations, like trade policy and labor market policy, that it can be seen as something that happened independent of policy. If trade policy or labor market policy explain the transfer of...

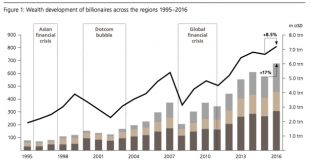

Read More »The gilded age: a tale of today*

from David Ruccio The timing could not have been better, at least for me. It just so happens I’m teaching Thorsten Veblen’s Theory of the Leisure Class this week. It should become quickly obvious to students that, as I have argued before on this blog, we’re now in the midst of a Second Gilded Age. This is confirmed in a new report by UBS/PwC, according to which, after a brief pause in 2015, the expansion in billionaire wealth around the world has resumed. Thus, billionaire wealth rose...

Read More »Duopolie

from Asad Zaman Varian start his intermediate micro text by stating the maximization and equilbrium are the core principles of micro. Krugman recently stated that I am a “maximization and equilibrium” kind of guy. The goal of this lecture is to show that these two principles fail completely to help us understand behavior is a very simple model of a duopoly. In last lecture (AM03), we introduced a simple duopoly model. Two ice-cream vendors buy ice-cream wholesale and can sell at any...

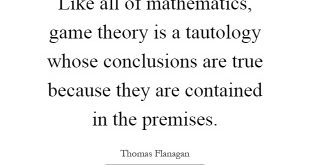

Read More »Pure game theory — an irrelevant tautology

from Lars Syll Applied game theory is a theory of real-world facts, where we use game theoretical definitions, axioms, theorems and (try to) test if real-world phenomena ‘satisfy’ the axioms and the inferences made from them. When confronted with the real world we can (hopefully) judge if game theory really tells us if things are as postulated by theory. But there is also an influential group of game theoreticians that think that game theory is nothing but pure theory, an...

Read More »Reconcile this!

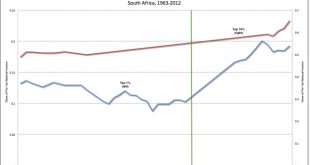

from David Ruccio The world joined most South Africans in cheering when Nelson Mandela was finally released from prison, the apartheid regime was largely dismantled, and multiracial elections were eventually held. Then, of course, the really hard work of restorative justice began, under the aegis of the Truth and Reconciliation Commission. To avoid victor’s justice, no side was exempt from appearing before the commission, which heard reports of human rights violations and considered...

Read More »The Golden “Diwali Gift”

from Jayati Ghosh The Modi government made its supposed determination to end corruption in India its signature theme. The massive damage done by demonetisation as well as the continuing chaos produced by the flawed introduction of the Goods and Services Tax have all been justified on the grounds of reducing possibilities of corruption and tax avoidance. Similarly, the imposition of Aadhaar requirements on the population for access to all manner of publicly provided goods and services is...

Read More »Chicago economists — people who have their heads fuddled with nonsense

from Lars Syll Mainstream macroeconomics has always had problems with the notion of involuntary unemployment. According to New Classical übereconomist Robert Lucas, an unemployed worker can always instantaneously find some job. No matter how miserable the work options are, “one can always choose to accept them,” according to Lucas: KLAMER: My taxi driver here is driving a taxi, even though he is an accountant, because he can’t find a job … LUCAS: I would describe him as a taxi driver...

Read More »Explicit and tacit explanations of French economic stagnation

from Robert Locke In my October 24 posting, Sapiential Economics, I plug for the inclusion of tacit as well as explicit analysis in the treatment of economics. This posting illustrates my case through example. French Revisionism, explicit knowledge and the stagnation thesis In 1976 Explorations in Economic History published Richard Roehl’s article using statistics to refute the view of French economic stagnation. “The conventional picture,” he states, “Is roughly as follows. The French...

Read More » Real-World Economics Review

Real-World Economics Review